.png)

Michael Debabrata Patra

Michael Patra is an economist and former RBI Deputy Governor.

TK Arun

Arun is a seasoned writer on economic and policy matters.

Abheek Barua

Abheek is an Independent Economist and the Former Chief Economist at HDFC Bank.

Ajay Srivastava

Ajay Srivastava is the founder of the Global Trade Research Initiative.

Vijay Chauhan

Vijay Singh Chauhan, a former IRS official, is a Senior Visiting Fellow at ICPP, Ashoka University

Dhananjay Sinha

Dhananjay, a D-School alum, is CEO and Co-Head of Equities at Systematix Group.

Kirti Tarang Pande

Kriti is a psychologist specialising in mental health, org behaviour, and brand strategy

Srinath Sridharan

Srinath is an author, corporate advisor, and independent director on corporate boards.

Sharmila Chavaly

Ex-civil servant Chavaly held key Railways, Finance roles; specialises in infra & PPPs

Nilanjan Banik

Nilanjan Banik, Professor at Mahindra University, specialises in trade and development economics.

Sachin Malhotra

Sachin was till recently an MD with Standard Chartered Bank.

Rajesh Mahapatra

Rajesh Mahapatra is the former Editor of The Press Trust of India

Krishnadevan V

Krishnadevan is Editorial Director at BasisPoint Insight.

Dev Chandrasekhar

Chandra advises companies on big-picture narratives on strategy and markets.

Kalyan Ram

Kalyan Ram co-founded Cogencis. He now leads BasisPoint Insight.

R. Gurumurthy

Gurumurthy is an ex-central banker who handled markets, and later, financial stability for RBI.

Lt Gen Syed Ata Hasnain (Retd)

Lt Gen Syed Ata Hasnain is a former Commander of India’s Kashmir Corps.

Arvind Mayaram

Arvind Mayaram, former Finance Secretary, is Chairman of the Institute of Development Studies, Jaipur.

The Bureau

Geopolitics

When Neutrality Becomes Silence

As wars increasingly become theatres for technological display, rising powers such as India may need to move beyond strategic autonomy and articulate the principles that should still govern the use of force.

BasisPoint Groupthink

Week in Numbers: Tracking India’s Economic Pulse

Datametricx

The Case For a Robot Tax

Abheek Barua

Supervising the System: RBI’s Quiet Governance Reset

As finance turns digital and interlinked, the RBI is redesigning supervision by shifting from balance-sheet checks to ecosystem-wide governance architecture.

Abhishek Dey

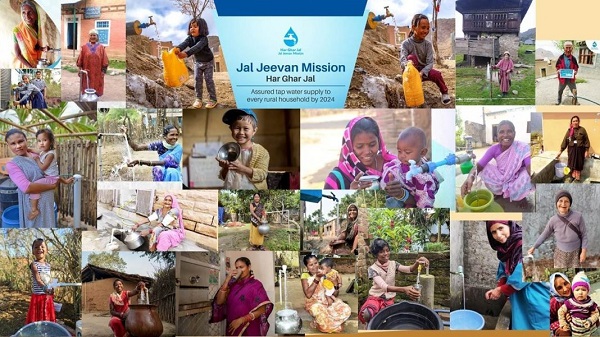

Clean Water’s True Price in Rural India

What rural households in Odisha reveal about the real economic value of safe drinking water, and why delivery models may outperform traditional fixes.

Amitrajeet A. Batabyal*

India’s GDP Reset Credibly Recalibrates the Growth Narrative

Shubhada Rao, Vivek Kumar, and Yuvika Singhal

Floating: A Double-Edged Sword

Floating exchange rates were meant to absorb shocks. This essay shows how, in emerging economies, they have often magnified crises instead.

Michael Debabrata Patra

When Kashmir Dreamed in Whites: It Was a Cricketing Spring in a Season of Turmoil

Lt Gen Syed Ata Hasnain (Retd)

Tamil Nadu 2026: The Three-Cornered Battle That Could Rewrite History

Tamil Nadu's 2026 elections are no longer a two-party race. With actor-turned-politician Vijay's TVK challenging the DMK-AIADMK duopoly, deep anti-incumbency, and wafer-thin poll margins, this could be the election that rewrites the state's political playbook.

Amitabh Tiwari

Tata Group’s Steady Hand Looks Less Settled

Krishnadevan V

What Will the Fed's "Warsh Era" Bring?

Mohamed A. El-Erian

Why India’s Municipal Bonds Need Founding Rigour, Climate Reset

Sharmila Chavaly

Glitch at NSDL Bares Cracks in India’s Market Machinery

Indra Chourasia

Mis-selling’s Structural Problem. But, What Next?

Srinath Sridharan

Banking on Perfection in an Imperfect World

R. Gurumurthy

Who Owns an Invention When a Machine Builds It?

As machines begin to generate ideas at scale, patent systems are scrambling to decide who owns them, and how much human input still matters.

Amit Singh

India Is Quietly Becoming the World’s Valuation Magnet

Chandrika Soyantar

Trump, Game Theory, and the Collapse of Credible Threats

Repeated reversals and institutional checks have eroded the credibility of Trump’s threats, turning shock strategy into predictable volatility.

R. Gurumurthy

Newsletter

Two Speeches, One Lie, and an Uncomfortable Reality

Rubio soothed Europe with familiar stories. Carney stripped them away. Two speeches, one anxious West, and what the gap means for India.

Phynix

Opinion

India’s Global AI Vision Needs Reform at Home

Calls for democratised AI ring hollow unless India fixes data access rules, procurement bias, and compute policy to empower start-ups and domestic innovation

Meghna Bal

Munich 2026 and The Limits of Strategic Comfort

Lt Gen Syed Ata Hasnain (Retd)

The End of a Lie

Antara Haldar

Why Exchange Rate Stability Matters More Than Ever for India

As alarmist calls on the rupee clash with the IMF’s own labels, this piece asks why exchange rates matter, and why stability cannot be left to markets alone.

Michael Debabrata Patra

Artificial Intelligence: Why the Biggest Revolution May Be Surprisingly Ordinary

Amitrajeet A. Batabyal*

Financing the Global South's Infrastructure Boom

Rakesh Mohan and Divya Srinivasan

Artificial Intelligence, Human Error, and Why Accountability Still Matters

AI dazzles, markets swing and elites stumble, yet accountability still anchors civilisation in an age of noise and overreach.

R. Gurumurthy

AI and the Global South's Next Leap Forward

Nandan Nilekani and Ashish Khanna

Beyond the Hype: What AI Means for Your Career

As AI tools grow more powerful, fears are mounting that they could disrupt India’s IT-led growth and threaten white-collar jobs. The real question is whether humans and AI will compete or collaborate, and whether India can turn disruption into opportunity.

Nilanjan Banik

Those Who Most Need to Understand AI Don't Get It

While anyone familiar with past technological hype cycles can see that today's predominantly young technologists are overly optimistic about AI's potential benefits, mainstream economists seem to suffer from tunnel vision of a different sort. If recent history is any guide, that should worry us all.

Charles Ferguson

India’s Next Growth Phase Needs Regulatory Courage

Anupam Sonal

Do Strikes Still Speak to Power?

Srinath Sridharan

Rising Imports and Costly Supply Chains Squeeze India’s Apple Economy

India’s apple economy is at a crossroads. Imports, now equal to roughly one-fifth of domestic production, will likely expand further.

Ajay Srivastava

India’s Consumption Boom Is Passing HUL By

Krishnadevan V

Risk-Based Deposit Insurance Framework Could Reshape Bank Behaviour

K. Srinivasa Rao