.png)

Groupthink is the House View of BasisPoint’s in-house columnists.

September 10, 2025 at 2:08 AM IST

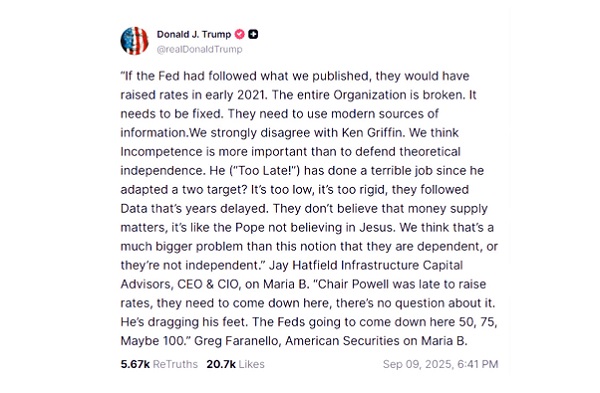

Donald Trump has never needed nuance when taking aim at the Federal Reserve. Jerome Powell, in particular, has long been the favoured punchbag of his populist broadsides. The insults have ranged from the theatrical to the petty: “clueless,” “bad golfer,” “enemy of the people.” Monetary policy was reduced to a shouting match, complete with capitalised demands for rate cuts.

Yet something curious happened in his latest post. Amid the familiar chaos of names, quotes, and italics, Trump reached for an argument that sounded almost…intellectual.

He claimed the Fed should have lifted rates back in early 2021, accused it of ignoring money supply data, and sprinkled in citations from bond strategists. And then, in a flourish that was part theatre, part logic class, he likened the Fed’s rejection of money supply to the Pope rejecting Jesus.

The line is ridiculous and brilliant at the same time. By using reductio ad absurdum, Trump reframed his disdain not as a gut-level tantrum but as a kind of higher-order critique. The Fed, he implied, has abandoned its most basic catechism. His followers saw humour, his detractors rolled their eyes, and market veterans, secretly, might have conceded that there was at least a sliver of truth in the parody.

This is not to suggest Trump has suddenly become a monetary theorist. The tweet still read like a wall of sound: part campaign speech, part late-night rant. But the style mattered. For the first time, Trump layered wit and market jargon over his usual hammer blows. It was still ridicule, but ridicule with footnotes.

The shift points to a new approach in his battle with Powell. Until now, the Fed was cast as an enemy obstructing growth and jobs. Now, it is painted as incompetent, out of touch, and even heretical in its own discipline. By adopting a quasi-intellectual tone, Trump appeals not just to his base but also to investors who have long grumbled that the Fed’s policy errors stoked inflation. The effect is to turn a political jab into something resembling a serious critique — even if dressed in carnival colours.

For Powell, the problem is that the theatre works. A central banker’s defence must always be technical and restrained; that makes it no match for an adversary armed with jokes about pontiffs and messiahs. Each time Trump goes playful, he makes Powell look dour. Each time he drops a strategist’s name, he makes Powell look isolated.

It would be easy to dismiss this as just another Trump eruption. But the performance deserves attention precisely because it tries to fuse intellectual dissent with populist bite. If his earlier strategy was brute force, this one aims to out-think as well as out-mock. And in the arena of public opinion, that cocktail can be potent.

Powell will not respond in kind. Central banks do not spar on social media. Yet silence, too, has its risks. The timing adds to the drama: coming off his careful messaging at Jackson Hole, the FOMC meets again later this month, with the CME FedWatch tool showing traders don’t expect that Powell will dare to hold off at least a 25-basis-point cut.

For every meme or reductio ad absurdum that goes unanswered, the Fed’s authority looks a little less secure. Trump, sensing this, is turning monetary debate into a running punchline, one that investors and voters alike can laugh at, nod to, or share.

A new approach, then, but with the same destination: weaken Powell, and by extension the Fed, in the eyes of the public. What makes this moment interesting is that Trump is no longer satisfied with brute insults. He wants to prove that he can win the argument as well as the applause line. Whether that makes him more dangerous to the Fed, or merely more entertaining, is a question Powell would rather not have to answer.