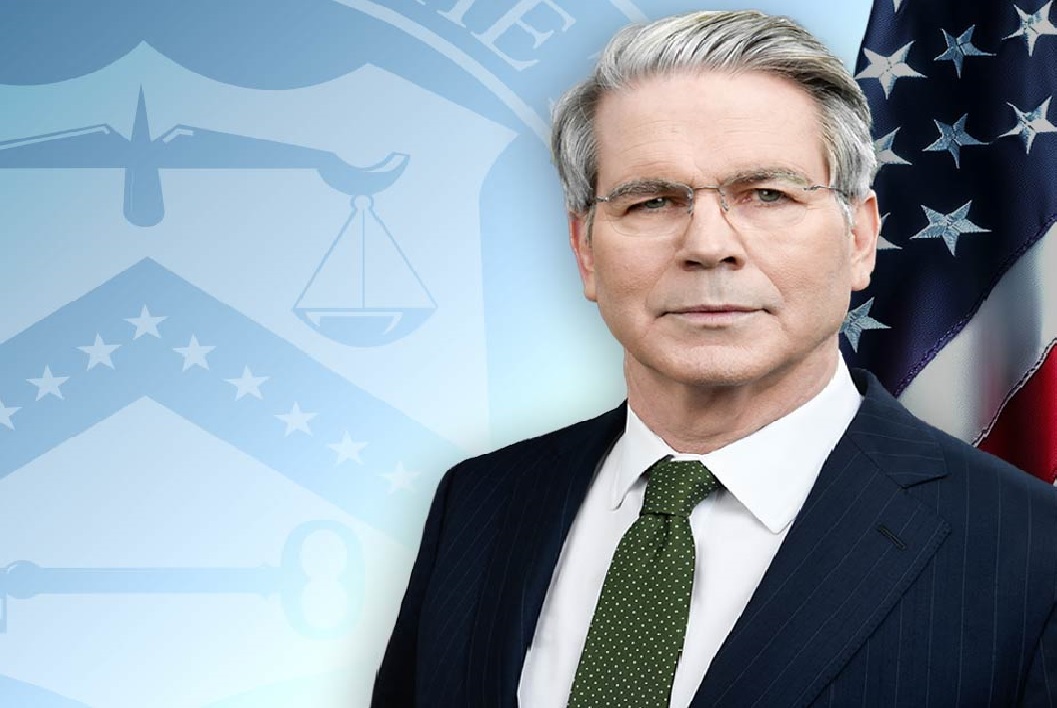

Where you stand on an issue, the late US bureaucrat Rufus E. Miles, Jr., observed in 1948, depends on where you sit. Scott Bessent, the former hedge-fund operator now serving as US President Donald Trump’s Treasury Secretary, personifies this dictum.

As an investor, Bessent displayed clear-eyed realism and a knack for capitalizing on a country’s economic imbalances to reap big returns. In 1992, for example, he famously helped George Soros make a killing by exploiting the Bank of England’s hopeless defense of an overvalued pound sterling. But as Treasury Secretary, Bessent is supporting a grossly irresponsible budget and foreign policy, which is putting the United States on a path to economic ruin.

At this point, it is not news that the One Big Beautiful Bill that Trump signed into law last summer – of which Bessent was a leading architect – represents a fiscal catastrophe. The Congressional Budget Office estimates that the legislation, which includes major unfunded tax cuts, will add $3.4 trillion to the budget deficit over the next decade. According to the International Monetary Fund, the US budget deficit is now on track to exceed 6% of GDP for the foreseeable future, driving the public debt to 143% of GDP by 2030 – about the level seen in Greece and Italy when their sovereign-debt crises erupted in 2010-11.

But Bessent has continued to choose loyalty to Trump’s reckless whims over any semblance of fiscal responsibility. He has voiced no opposition to Trump’s proposal to increase the defense budget by $500 billion over the next two years. Nor has he resisted Trump’s plan to issue $2,000 tariff “dividend” checks to most American households. Together, these proposals risk increasing the budget deficit – already running at around $2 trillion annually – to a level that would be extremely difficult to finance without stoking inflation.

Trump’s attacks on the Federal Reserve’s independence are compounding fears that the US will try to inflate away its debts. Bessent is well aware of this. But, while he may have sought to discourage Trump from trying to fire Fed Chair Jerome Powell, he has not publicly resisted Trump’s other assaults on the central bank, including his effort to fire Fed Governor Lisa Cook. And Bessent has not given any indication that he will push back against Trump’s appointment of a pliable successor to Powell, whose term expires in May.

But perhaps Bessent’s most egregious lapse relates to America’s dependence on the kindness of strangers to finance its gaping deficits. Foreign investors own some $8.5 trillion worth of US Treasuries – about 30% of the $30 trillion outstanding. Of that total, $1.7 trillion is held by Europeans, the longtime allies whom Trump appears committed to alienating, not least with his efforts to annex Greenland, a semi-autonomous territory of Denmark.

Just as Bessent showed no resistance last year to Trump’s erratic tariff policy, which has sown market uncertainty and hurt America’s traditional allies more than its foes, he has not challenged Trump’s threats to impose new tariffs on European Union countries that oppose his Greenland grab. “Sit back, take a deep breath, and let things play out,” he told European leaders at the World Economic Forum in Davos. “Do not retaliate.”

Bessent has also downplayed the risk that Trump’s aggressive posturing might trigger a selloff of US bonds by European investors – a risk that is compounded by the Trump administration’s weaponization of financial policy against Russia and Iran. When it was revealed that the Danish pension fund AkademikerPension would sell off its US Treasury holdings, worth about $100 million, by the end of this month, Bessent derisively said, “Denmark’s investment in the US Treasury bonds, like Denmark itself, is irrelevant.”

Markets are not convinced. On Tuesday, the Dow, S&P, and Nasdaq all had their worst days since October 10, when Trump threatened to raise tariffs on China. Meanwhile, the dollar index fell 0.8%, and gold prices reached record highs.

While news of a “framework” deal on Greenland between Trump and NATO Secretary-General Mark Rutte has sparked something of a rally, these trends have been gaining steam for a while. Over the past year, the dollar has lost 10% of its value, despite higher import tariffs and the maintenance of a significant short-term interest-rate differential with other major economies, and gold prices have climbed 70%.

Another key indicator of declining faith in the US is the all-important 10-year US Treasury yield, which has risen 50 basis points since September 2024, even as the Fed has cut its policy rate by 175 basis points (which would typically lead to lower long-term interest rates). Ten-year yields are now approaching 4.3%, with the 30-year Treasury yield at 4.92%.

During his first presidency, Trump was prevented from acting on his worst impulses. During his second presidency, the adults seem to have left the room – and investors are paying attention. Rather than continuing to back Trump’s reckless policies, Bessent should be highlighting the danger of undermining foreign investors’ confidence in the US. Unless Trump’s economic and geopolitical excesses are reined in soon, the US – and the rest of the world – will pay a high price.

.png)