.png)

A Year of Recalibration at Mint Street

Governor Malhotra’s first year at the RBI brought cleaner rules, quieter reversals, and a distinct shift in tone as the technocrat adjusted to the institution’s rhythm.

Kalyan Ram, a financial journalist, co-founded Cogencis and now leads BasisPoint Insight.

December 11, 2025 at 5:25 AM IST

There are institutions that change noisily, and those that change by almost rearranging the air around them. The Reserve Bank of India has usually belonged to the latter category, and the past year has reinforced that impression. Nothing dramatic has unfolded on Mint Street, yet the institution seems to carry itself differently. The familiar routines remain, the corridors still hold their quiet, and the temperament of the place has not been jolted in any visible way. Even so, something in the grain of its functioning has shifted since Sanjay Malhotra took charge, not as a deliberate break from the past, but as a gradual realignment of how the central bank understands its own space.

Malhotra’s first year has not been the story of a governor arriving with a rigid doctrinal agenda. It has been the story of someone trained in the habits of government stepping into a technocratic institution and learning to breathe within its discipline. The shift has been subtle and occasionally uneven, often revealing the instincts he has carried from years in the bureaucracy. Those instincts have begun to seep into the RBI’s operational culture in a steady rather than dramatic way, leaving an imprint that makes the institution feel changed at its margins.

Bureaucratic Imprint

Those who work with him speak of long days that stretch into evenings, of a governor who reads closely, questions sharply, and moves without unnecessary flourish. There is an unmistakable tidiness to his method, the kind that comes from years of managing administrative sprawl. He looks for loose threads in a document, overlaps that create ambiguity, and procedural habits that persist out of inertia. Meetings under him often end with clearer edges, even when the subject itself remains complex.

Yet, the impression he has left on the organisation is not confined to his work ethic. It lies equally in what he has chosen not to emphasise. His predecessors often cultivated the relational layer of central banking, quiet conversations with bankers, unhurried calls with market veterans, and occasional gestures that signalled, without saying much, that the institution was listening. Malhotra has been more sparing with that bandwidth. Several bank chiefs have noted that they have not had a one-to-one meeting with him, except in larger gatherings. It has not caused friction, but it has altered the geometry of interaction inside Mint Street.

For an institution whose credibility rests as much on its listening as its pronouncements, that narrowing of contact points has not gone unnoticed.

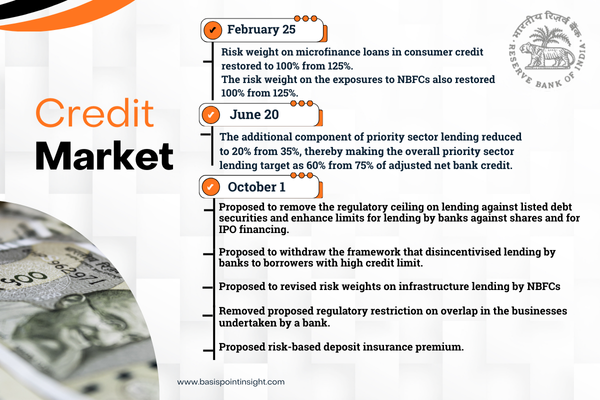

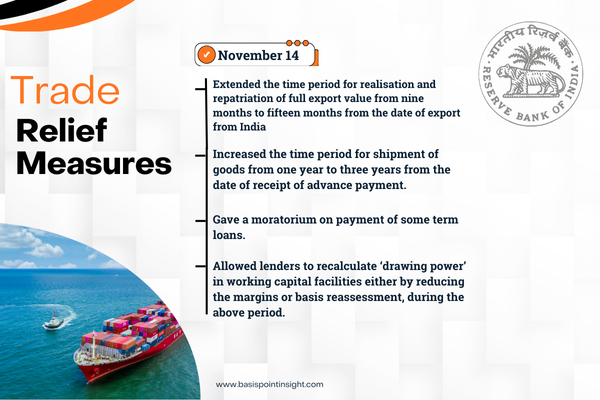

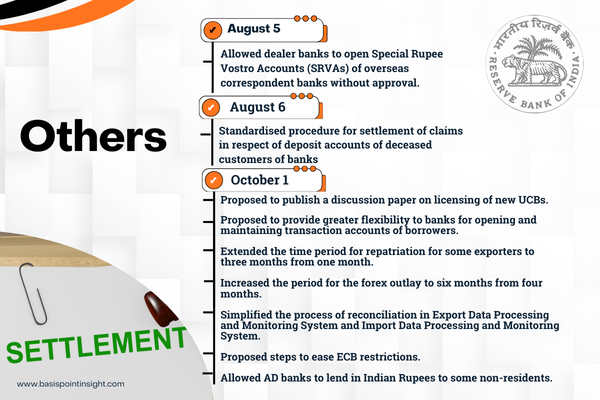

That geometry has shown up in policy choices as well. Some of his early decisions carried the imprint of someone trained to see when a rule has outlived its purpose. Risk weights raised in earlier years returned to more familiar levels. Small finance banks, which had been carrying heavier priority sector burdens, found more realistic targets. The framework discouraging large corporate exposures was quietly allowed to retire. Lending channels that had narrowed through successive caution were reopened, whether through relaxed limits on share-backed loans or through an enabling framework for acquisition financing. Each move may have been modest on its own, but taken together, they suggested an effort to loosen the regulatory grip where it felt overly tight, without signalling any larger philosophical turn.

The market’s response was mixed. Some saw a welcome recalibration after years of incremental tightening. Others wondered if the timing was too permissive. Even this ambiguity seemed to match Malhotra’s early tenure, careful in intent, attentive in detail, yet still finding its equilibrium.

But the absence of an accompanying narrative that might have located these shifts within a broader policy arc was unmistakable.

Lean Rulebook

Regulation at the RBI has always been cumulative. Circulars stacked upon circulars, clarifications sat next to contradictions, and compliance teams across the system navigated them with caution, knowing that the wrong interpretation could be costly. By drawing decades of regulatory memory into living documents that now carry the institution’s intent more clearly, Malhotra and his team have begun the slow work of unburdening the system. The Master Directions are not a new architecture, but a tidier one, and tidiness can often be transformative for an institution long weighed down by its own paper.

What makes this reform distinctive is not its ambition but its discipline. It requires constant upkeep and a willingness to revisit and update, rather than allow outdated instructions to settle again. The creation of a Regulatory Review Council suggests that Malhotra sees this not as a one-time clean-up, but as an ongoing exercise. Banks, NBFCs, and fintechs may not feel the change immediately, but over time, a rulebook that is easier to read becomes a rulebook that is easier to follow, and perhaps even easier to defend.

The consolidation sits within a broader internal shift. The institution has spent a year adjusting to a governor with a sharper view of internal efficiency. Travel budgets, event expenditures, wage revisions, and compliance burdens have all been examined with a quiet seriousness that signals a preference for restraint. It is not an aesthetic of austerity, but an insistence that the institution’s resources be used with clarity of purpose. Departments that once lived with comfortable procedural habits have been nudged to streamline their work, at times gently, and at others firmly. It is a kind of internal housekeeping that rarely enters public discourse, yet it shapes how an institution sees itself.

Communication Conundrum

Malhotra’s style, precise, written, and measured, has not yet bridged that interpretive space. This is also where a more deliberate effort to listen to markets — directly or indirectly — could serve him well. Bankers have a stake in the macroeconomic framework, financial stability, and the broader equilibrium that bond yields and exchange rates attempt to reflect. In earlier years, a neutral, almost ritualised posture, in the form of structured interactions, in which the RBI brass asked more than it revealed, strengthened that feedback loop without compromising policy discretion. His public appearances reflect something similar. During the October monetary policy press conference, there were moments when his composure felt carefully held, as though he was aware of the institution’s weight resting upon him. The pauses seemed to stretch slightly, the voice steadied itself with effort, and the room sensed that central banking often demands a kind of performed calm. These were not signs of uncertainty but reminders that the role requires a degree of presence that must be grown into, not assumed.

It is too early to know whether Malhotra will grow into the fuller public presence the RBI sometimes requires, or whether he will continue to shape the institution through the quieter virtues of order and method. For now, the central bank carries itself with a slightly different gait, a little less encumbered by its own paperwork, a little more exacting in its internal routines, and a little more aware that transitions do not announce themselves. They gather slowly, one careful adjustment at a time.

Perhaps that is how this tenure will be remembered: as a period when the RBI did not change its direction so much as refine its stance, when the institution paused to straighten its own files; when the governor chose to understand the room before trying to occupy it fully.

Mint Street has known many shades of leadership. Malhotra’s version, still unfolding, belongs to the gentler art of recalibration, the kind that takes time to be seen and even longer to settle into the grain of an institution that has always prized continuity over noise.

One responsibility that will matter more with time is the quieter work of preparing a steady runway for those who will follow. Malhotra walked into an unusual degree of churn, new deputies, new teams, and an institution still finding its balance after several rapid shifts. Having set many changes in motion almost at once, he now has the space to ease the pace, let the dust settle, and give the frameworks he has begun the chance to breathe. In an institution that thinks in generations, not tenures, the ability to leave behind something coherent and settled is often the most understated form of leadership a governor can offer.

Whether that gentleness can coexist with the sharper communicative demands of modern markets is an open question, one that the coming year will test more firmly.

Also read: Malhotra’s RBI: Between Freedom and Friction