.png)

Grandfathered, Then Burned: Why the Government Must Lead the Tiger Appeal

India promised tax certainty through grandfathering. The Supreme Court's Tiger Global verdict undermines that. It’s the government that must restore credibility.

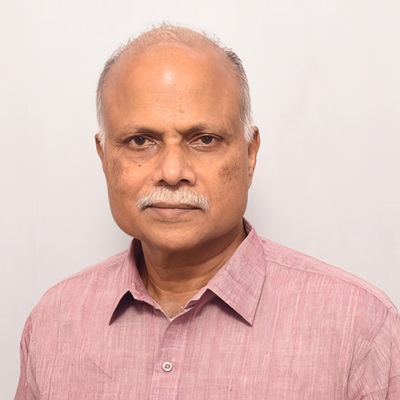

T.K. Arun, ex-Economic Times editor, is a columnist known for incisive analysis of economic and policy matters.

February 5, 2026 at 4:54 AM IST

It is a mystery why the government did not address, in the Budget, the damage done to India’s tax credibility by the revenue authorities’ pursuit of capital gains tax on Tiger Global’s partial exit from Flipkart at the time of WalMart’s acquisition of Flipkart.

Tiger Global had invested in Flipkart via three Mauritius-based subsidiaries over 2011-15, and their holdings were sold to a WalMart investment company in 2018, to transfer ownership and control of Flipkart to the American retail giant. Tiger Global invested in a holding company in Singapore, which owned the operating subsidiary in India.

At the time of acquisition, the tax law in India said that Mauritius-resident companies were exempt from capital gains in India on their investments made in India, provided these investments had been made prior to 2017. Investments routed via Mauritius entities lost their tax exempt privilege after 2017. In the quaint language of taxmen, when investments from Mauritius were subjected to tax in India after 2017, the investments prior to 2017 were ‘grandfathered’.

The term grandfathering has its origin in American racism. After the abolition of slavery, black men were given the vote in 1870. The Southern states invented a way to deny their former slaves the vote granted by an amendment to the Constitution. They brought in eligibility conditions: literacy and payment of poll tax. Most black people became ineligible. But then, so did many white men (women got the franchise five decades later). In order to shield them from disenfranchisement, an exception was made to the eligibility test: you were eligible to vote, even if you were illiterate and could not pay the poll tax, if your grandfather had been eligible to vote. Grandparents have many uses. Shielding old privilege from the impact of changes in rules got added to the list.

Tiger Global sought certification of exemption from capital gains tax on its investments in Flipkart made prior to 2017. It was rebuffed. It approached the Authority for Advance Ruling. No luck. It moved the Delhi High Court. The Court found merit in its plea and ruled against the taxman. The taxman moved the Supreme Court.

Instead of accepting and respecting the intent of grandfathering prior investments, when the exemption from capital gains tax for investments routed through Mauritius-based entities was done away with in 2017 with prospective effect, the Court overturned the decision of the Delhi High Court. Tiger Global is obliged to pay capital gains tax, it ruled.

In dozens of cases, high courts have granted exemption from capital gains tax to assorted entities that had invested in India via Mauritius and made capital gains when they exited these investments. Now the taxman can reopen all of them. If he did not, a putative Vinod Rai could indict him for causing notional loss to the exchequer.

The Supreme Court decided that a tax residency certificate from Mauritius was not sufficient to determine if an entity claiming tax exemption under the Indo-Mauritius treaty was eligible to that exemption. It must be a substantial presence in Mauritius to qualify for benefits under the treaty. The Court found, rightly, that Tiger Global was only routing investments via Mauritius to get the benefit of the tax treaty, and so was not eligible for tax exemption. Adopted grandfathers would not do, my friend.

The Court also found that the Indo-Mauritius treaty only covered investments from Mauritius in Indian entities, not holding entities in Singapore. So, Tiger, yowl somewhere else about the short shrift you’re getting in India.

Really?!

Did Indian authorities really imagine that Mauritius was a busy business hub, teeming with homegrown entities filled to the gills with investment dollars eager to deploy in India, when they signed the tax treaty? Or were they eager to attract investors to India and offered them a tax-exempt route via the treaty with Mauritius? Tax is not the primary benefit from capital inflows: these create new business, new jobs, entrepreneurship, income and a virtuous cycle of growth.

It is the prerogative of the Executive to decide on policy, and Courts have no business to second-guess the Executive on policy. It is precisely such second-guessing that is at work when the Court sorts certified tax residents into genuine grandfathers and synthetic fauxbears.

The Supreme Court ruled, in 2012, against the tax department’s right to tax the capital gains on the indirect transfer of Hutch -Essar in India to Vodafone by Hutchison’s sale of a holding company in the Cayman Islands to a Vodafone investment arm. Pranab Mukherjee, as the then-finance minister, moved an amendment to the tax code saying it had always been the intent of the law to tax capital gains on indirect transfers as well.

The Finance Bill brought in Explanation 5 to Section 9(1)(i), which deals with the source rule for determining taxability in India. The Explanation states that a share of a foreign company is deemed to be situated in India if it derives "substantial value" from assets located in India. Its retrospective application was withdrawn in 2021 to dump the tax demand on Vodafone, but the provision still stands.

This would mean that the Supreme Court’s finding that the Indo-Mauritius tax treaty’s ambit does not extend to the Singapore holding company is puzzling, to say the least.

In refusing to accept the legislative intent in grandfathering investments made prior to 2017 while withdrawing tax exemption under the Indo-Mauritius treaty, and refusing to recognize the purview of Explanation 5 to Section 9(1)(i), the Court has eroded India’s tax credibility. This damage has to be undone, by an appeal to a bigger bench by the government, or by fresh legislation.