.png)

Transforming India's Grid for a Renewable Future

India’s renewable push is running ahead of grid readiness. As variability strains stability, the Budget must pivot from capacity addition to firm power, storage and grid modernisation to secure reliable, clean energy growth.

Sharmila Chavaly, ex-senior civil servant, specialises in infra, project finance, and PPPs. She held key roles in railways and finance ministries.

January 23, 2026 at 10:14 AM IST

Of late, India’s renewable energy ambitions have been facing critical stability and security challenges. Putting aside, for the moment, the financially stressed DISCOMs, let’s take stock of where we stand: there has been progress towards the goal of 500 GW non-fossil capacity by 2030, but the grid has been struggling with the variability of solar and wind power. The problems of the chronic infrastructure deficit have been compounded by the immediate need for firm, dispatchable power in the industrial economy. It is in this context that the stringent new grid codes and the resurgence of nuclear energy in the policy discourse underscore the shift in focus from mere capacity augmentation to securing capacity integration.

The annual Budget is the opportunity to introduce a time-bound mission-critical programme which couples renewable energy growth with firm power and grid modernisation. This would mean a strategic shift from blanket-funding to performance-linked investments in nuclear energy, grid-scale storage, AI-enhanced transmission, and, of course, DISCOM reform, with strict milestones to ensure energy security.

The Core Problem

- Transmission gaps: There is a systemic 40%+ shortfall in delivering planned interstate and intrastate transmission assets- grid projects take 5-8 years on average for completion, versus the 1-2 years for solar plants, creating an evacuation bottleneck.

- Execution Bottlenecks: Fragmented clearances, land acquisition challenges, and lack of coordinated monitoring between central and state agencies cripple project timelines. Added to this is the perennial problem of DISCOMs, whose accumulated losses exceed ₹5 trillion - they lack capital for grid upgrades and often delay payments, creating uncertainty for generators.

- Flexibility: The grid lacks adequate flexible, dispatchable resources (storage, hydro, and gas) to balance the weather-dependent swings of solar and wind power, creating both, evacuation and stability bottlenecks. The real sector requires reliable, 24/7 power but renewable energy has been seeing routine curtailment - conservative estimates put the annual revenue loss to the RE sector at ₹30 billion – 50 billion, undermining both project economics and investor confidence.

- The new operational reality: Grid operators are now enforcing strict scheduling and penalty mechanisms for renewable energy plants. This is a fundamental shift, from treating renewables as “must-run” with flexibility to holding them accountable for forecast accuracy, reflecting the physical limits of grid inertia and balancing. An inflexible grid with high variable renewable energy penetration is vulnerable to frequency deviations and cascading failures. The new grid codes are a direct response to this threat which poses a direct risk to essential services and continuous supply to the energy-intensive manufacturing sector.

Mitigating Energy Security and Grid Reliability Risks

- Establish a firm-power foundation with Nuclear & Storage

- Nuclear: Implement fiscal parity for nuclear energy by extending GST benefits and green finance access akin to standard RE. Allocate catalytic capital to kickstart private sector participation under the SHANTI Act and fast-track the ₹200 billion Small Modular Reactors mission with defined deployment milestones.

- Storage as Infrastructure: Launch an expanded National Storage Mission to meet the projected need of 336 GWh by 2030. Use reverse auctions with declining Viability Gap Funding to scale beyond the current 43GWh target. Mandate storage procurement in state power plans.

- Milestone: Achieve financial closure for the first private nuclear venture and 10 GW/ 40 GWh of installed storage capacity by 2027.

- Nuclear: Implement fiscal parity for nuclear energy by extending GST benefits and green finance access akin to standard RE. Allocate catalytic capital to kickstart private sector participation under the SHANTI Act and fast-track the ₹200 billion Small Modular Reactors mission with defined deployment milestones.

- Modernise the Grid with Performance-Linked Funding

- Establish a ₹3 trillion, 5-year Grid Modernisation Fund. Disbursements to PowerGrid and State Transmission Utilities should be tranched and conditional on hitting milestones for project completion time, cost, and land acquisition.

- Conditionality: Mandate adoption of AI-based grid management (for forecasting, dynamic line rating) and the integration of the India Energy Stack (IES) digital platform to enable real-time monitoring and market operations.

- Milestone: Reduce average transmission project completion time by 25% and demonstrate full India Energy Stack pilot integration in one region within three years.

- Establish a ₹3 trillion, 5-year Grid Modernisation Fund. Disbursements to PowerGrid and State Transmission Utilities should be tranched and conditional on hitting milestones for project completion time, cost, and land acquisition.

- Reform the Last Mile (the elephant in the room, DISCOM reforms):

- Replace the current Revamped Distribution Sector Scheme approach with a “Smart Metering Plus” performance contract. Bundle funding for smart meters with investments in Meter Data Management Systems, AI analytics for theft/loss reduction, and targeted grid upgrades.

- Offer a larger consolidated grant (30-40%), released in tranches only upon demonstrating reductions in AT&C losses and improved financial sustainability.

- Milestone: All participating DISCOMs to reduce aggregate technical and commercial losses to 12% and achieve 100% smart meter integration in urban areas by 2029.

- Replace the current Revamped Distribution Sector Scheme approach with a “Smart Metering Plus” performance contract. Bundle funding for smart meters with investments in Meter Data Management Systems, AI analytics for theft/loss reduction, and targeted grid upgrades.

- Enact Enabling Legislation & Market Reforms

- Legislative Push: Use the Budget speech to strongly endorse the passage of the Electricity (Amendment) Bill, which is critical for enabling competition and privatisation in distribution, and to affirm support for the SHANTI Act framework.

- Market Modernisation: Allocate resources to regulators to fully implement the national “market coupling” mechanism by 2026, creating a single, efficient spot market for power that improves grid balancing across regions.

- Legislative Push: Use the Budget speech to strongly endorse the passage of the Electricity (Amendment) Bill, which is critical for enabling competition and privatisation in distribution, and to affirm support for the SHANTI Act framework.

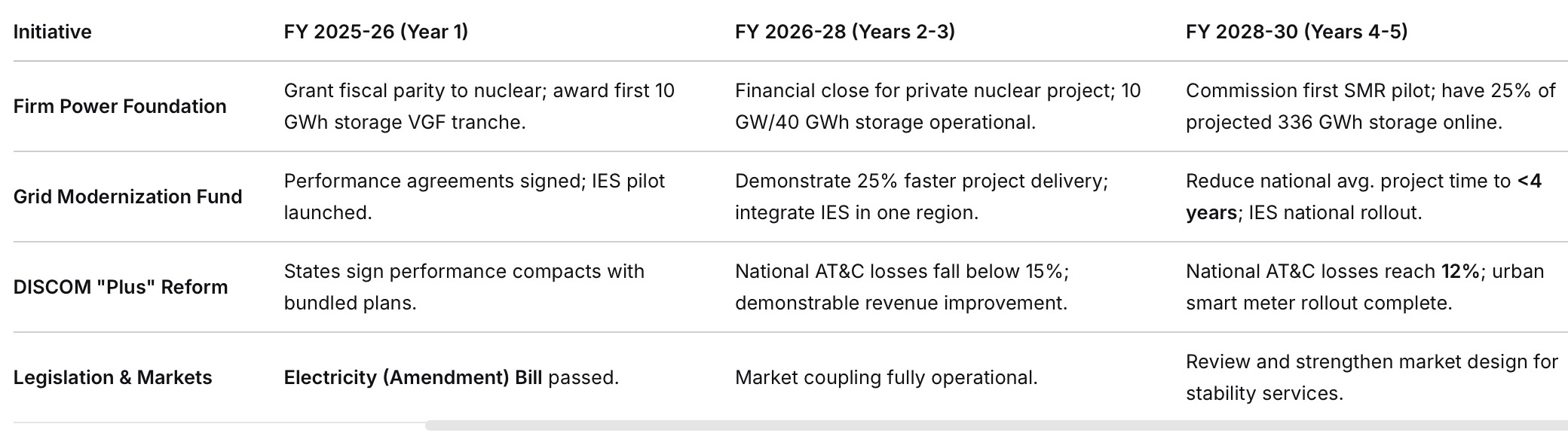

These would tie into timelines to be monitored over the next five years (the numbers are estimates):

India’s energy transition has reached a stage where reliability is as critical as capacity. Signalling, through the Budget, a shift from chasing renewable megawatts to building a resilient, firm, and intelligent electricity system would address this.