.png)

DV Ramana is a Professor of Accounting at the Xavier Institute of Management, Bhubaneswar.

December 7, 2025 at 2:19 PM IST

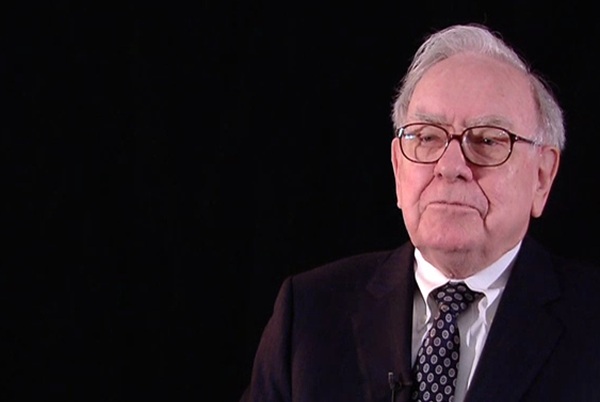

At 95, Warren Buffett steps back from writing Berkshire Hathaway's annual report, a ritual that everyone used to wait to read and listen to his long speeches. “I will no longer be writing Berkshire's annual report or talking endlessly at the annual meeting. As the British would say, I'm 'going quiet.” This is the beginning of his 6,000-word letter addressed to the shareholders of his company. In this letter, Buffett has shared essential messages for everyone in society, not just corporate executives or shareholders.

Reading the letter signals to us that he is not only an excellent value creator for his shareholders but also a warm person and a great storyteller with a powerful message. Using 6,000 words, he took us on a journey of 90 years and showed us the future, too. Though the letter is addressed to Berkshire's shareholders, it is full of messages that can be used by anyone.

This article expands on the ideas he shares in the final section of his letter, using examples of financial irregularities from well-known Indian companies. Here are Buffett’s Eight Principles of Financial Leadership drawn from his eight-page letter.

Eight Principles

Learn from past mistakes. "Don't beat yourself up over past mistakes, learn at least a little from them and move on." According to Buffett, every action, irrespective of the result, should be followed by a thoughtful post-mortem analysis. In finance, this mindset is equally important. After every financial failure, it is necessary to conduct a dispassionate examination and take action accordingly. Such actions may reduce the likelihood of repeating costly errors.

In the case of Kingfisher Airlines, its management refused to acknowledge early operational problems and instead continued reckless expansion. Similarly, IL&FS, instead of admitting solvency stress and addressing liquidity problems early, buried them by continuously rolling over debt. Buffett warns that the cost of ignoring mistakes compounds if they are not fixed early.

Choose your heroes very carefully and then emulate them. He stressed the benefit of utilising the performance and ethics of industry leaders to set internal standards and models for behaviour and strategy. Emulating the leader means adopting high ethical standards across different aspects of management.

In the Videocon-ICICI Bank scandal, leadership failed to embody ethical stewardship by allegedly sanctioning loans despite known financial distress, driven by internal influence.

Live Your Obituary. Buffett advises to "Decide what you would like your obituary to say and live the life to deserve it. Managers must resist pressure to make decisions that boost short-term earnings at the expense of long-term sustainable value.

Satyam Computers committed falsification of cash balances and inflated revenues. Had the Founder and CFO applied the Obituary Test of "Do I want my obituary to say I engineered fake earnings?", then long-term reputation would have taken priority over short-term valuation boosts.

Focus on Intrinsic Value. "Greatness does not come about through accumulating great amounts of money, great amounts of publicity or great power in government”. Buffett reminds leaders to focus on durable value, not just on market excitement.

Finance leadership at DHFL prioritised aggressive expansion and valuation over solvency. DHFL chased size and market share instead of focusing on compounding ethically, as Buffett advises.

Manage market expectations and volatility prudently. The market system creates immense opportunity but is also "capricious" (volatile) and "venal" (can reward bad behaviour in the short term). Buffett stresses the importance of a long-term approach that focuses on maintaining a strong balance sheet to survive inevitable short-term fluctuations.

IL&FS, through innovative accounting practices, concealed liquidity problems and over-relied on short-term borrowings, failing to build a strong balance sheet.

Reduce Compliance and Ethical Risk. Buffett said, “Whether you are religious or not, it's hard to beat the Golden Rule as a guide to behaviour." The Golden Rule is to be ethical in all dealings. For finance managers, this means zero tolerance for deceptive accounting, insider trading, or predatory pricing schemes. A strong ethical culture is the best defence against regulatory fines, lawsuits, and reputation damage, which are major financial risks.

Satyam Computers was found to have inflated cash and margins. Satyam used the gaps in the GAAP to create a surreal world of prosperity. Buffett’s Golden Rule would have stopped the fabrication.

Be kind. "Kindness is costless, but priceless too.” A positive and kind culture fosters trust within the organisation. A finance team that trusts and respects its operational counterparts gets better data.

NSE Co-Location problem - Buffett says to treat all stakeholders fairly. NSE violated this by giving select brokers an unfair speed advantage. A fear-driven environment prevented employees from speaking up, stifling information flow.

Respect the role of people around you. Buffett's final wisdom distils a lifetime of market success into a set of human principles. He said, "A cleaning lady (man) is as much a human being as the Chairman(woman)”. Following this, the companies are expected to reduce the gap between top executives and those working on the shop floor.

For the finance manager, the lesson is clear. Long-term financial prosperity is not a function of financial tricks, but of enduring character, strong ethics, and the humility to learn from every mistake.

You will never be perfect, he concludes, “but you can always be better.”