.png)

Ajay Srivastava, founder of Global Trade Research Initiative, is an ex-Indian Trade Service officer with expertise in WTO and FTA negotiations.

February 10, 2025 at 9:13 AM IST

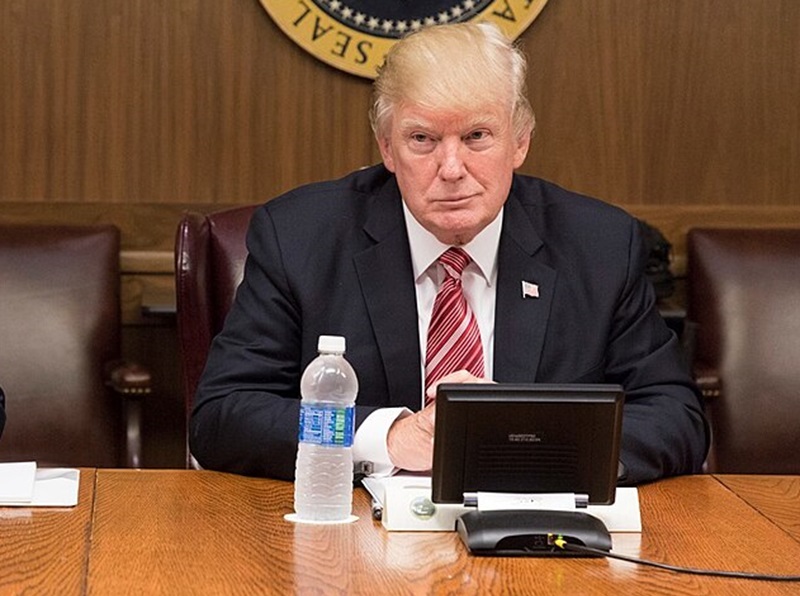

US President Donald Trump is set to announce new tariffs on steel and aluminum, similar to those imposed during the start of his previous term. He later used these duties as leverage to secure concessions for American goods in trade negotiations.

This time may be no different, but the stakes are higher, as escalating global trade tensions could have lasting economic consequences.

In March 2018, the Trump administration imposed a 25% tariff on steel and a 10% tariff on aluminum imports under Section 232 of the Trade Expansion Act, citing national security concerns. These tariffs covered most primary steel products, except stainless steel, and included steel pipes and tubes.

The tariffs applied to most countries, triggering a wave of retaliatory measures and escalating tensions in global trade.

Over time, the US government exempted several nations from these tariffs. In May 2019, tariffs on Canada, Mexico, and the European Union were lifted as part of renegotiated trade agreements. Brazil and Argentina were granted duty-free quotas, allowing them to export limited quantities of steel without tariffs. South Korea was also exempted but had to restrict its steel exports under a quota system. Australia received a full exemption from the outset.

China, however, remained subject to the tariffs, exacerbating trade tensions between the two economic giants.

More than five years after the initial tariffs were imposed, the US removed tariffs on steel and aluminum imports from India on July 3, 2023. The decision was part of a broader trade resolution announced during Prime Minister Narendra Modi’s visit to Washington. The agreement marked a thaw in trade relations between the two countries, with India committing to open its market further to US goods.

The latest threat, if carried out, could lead to new trade disputes and retaliatory measures from affected countries but may resonate with Trump’s base, particularly in the manufacturing and steel-producing regions of the country. However, such tariffs could lead to higher costs for American industries that rely on imported metals, potentially triggering inflationary pressures.

Trade Implications

If the new tariffs materialise, major steel exporters to the US, including China, South Korea, Japan, and the European Union, could respond with countermeasures. The European Union had previously imposed retaliatory tariffs on US products, including motorcycles and bourbon whiskey, after the 2018 tariffs.

China, which has been a long-standing target of US trade actions, could also escalate tensions by imposing tariffs on American agricultural and industrial goods. The move could further complicate the already fragile US-China trade relations.

US Imports

Since the trade war began in 2018, US steel and aluminum imports have continued to rise.

Primary steel imports increased from $31.1 billion in 2018 to $33 billion in 2024. The largest suppliers in 2024 were Canada ($7.7 billion), Brazil ($5 billion), and Mexico ($3.3 billion). Imports from China and India were $550 million and $450 million, respectively.

Steel pipes, tubes, and related products saw imports grow from $43.3 billion in 2018 to $52.7 billion in 2024. The biggest suppliers were China ($132 billion), Mexico ($7.3 billion), and Canada ($5.5 billion). Imports from India stood at $2.83 million.

Aluminum and related products imports increased from $24.2 billion in 2018 to $28.3 billion in 2024. Canada ($11.5 billion), China ($3.1 billion), and Mexico ($1.84 billion) were the top suppliers, while India's aluminum exports to the US reached $820 million.

As Trump considers reviving his aggressive trade policies, the world will be watching closely. If history repeats itself, the US steel and aluminum industries may benefit in the short term, but the global trade cost may be high.