.png)

Mint Owl tracks markets and policy with a steady eye, offering clear analysis on the choices shaping India’s economy and financial system.

August 21, 2025 at 1:39 PM IST

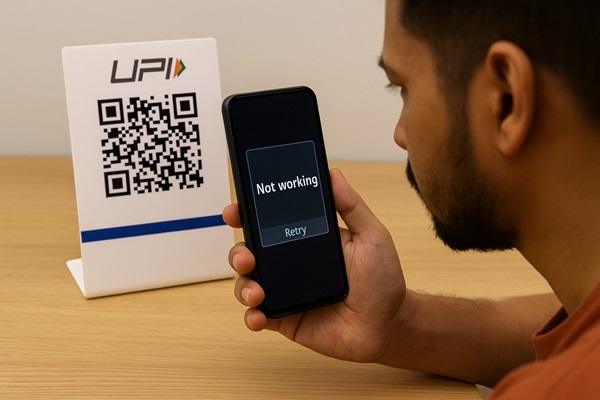

Every few months, rumours flare up that the government is about to levy charges on Unified Payments Interface transactions. Each time, social media erupts, finfluencers rage, and either the Reserve Bank of India or the government scrambles to issue denials.

The latest round followed RBI Governor Sanjay Malhotra’s nuanced comment that all payment systems carry costs, though there was no plan to charge users for UPI. Because he didn’t start with a flat “no”, misinformation spread again until the PIB, the governor himself and the government in Parliament stepped in to douse the fire.

This recurring cycle points to a deeper problem.

UPI may be free to users, but it is far from costless. Subsidies are thinning even as usage soars, stretching the system. Unless the government and RBI decide who will shoulder the burden, India’s most celebrated digital payments success story risks creaking under the weight of its own success.

An SBI report recently highlighted the scale of the mismatch.

The government’s subsidy supports small-value UPI and RuPay debit card transactions up to ₹2,000, largely benefiting small merchants. Yet while the ecosystem bears annual costs of ₹40 billion–₹50 billion, the budgeted subsidy for 2025-26 is only ₹4.37 billion. Worse, the allocation has been cut even as the industry asks for more support. Large merchants get no benefit at all, and most standalone payment players bleed money to keep the system running. Even banks, which can cross-subsidise, struggle with outages as platforms clog with small transactions.

The hard truth is that there are no free lunches in payments.

Maintaining secure, reliable networks demands constant spending on infrastructure and compliance. UPI’s design, routed through banks and other regulated entities under RBI oversight, only adds to the responsibility. The system’s success in boosting volumes is undeniable, but the cost has been thrust onto regulated players with little help from the state.

Politics, more than regulation, has sustained the pretence of “free”. RBI’s own 2022 Discussion Paper on Charges in Payment Systems raised fundamental questions about pricing UPI but has never been followed up.

Every time the idea of a Merchant Discount Rate or user fee surfaces, it collides with political will to preserve zero-charge transactions. Having nurtured the habit for so long, neither the government nor RBI wants to be the first to break the illusion. A stray remark from either authority still triggers outrage and hasty retreat.

That leaves the core policy dilemma. If UPI is to remain free for consumers, who will pay? Expecting banks and fintechs to absorb costs indefinitely risks underinvestment in security and infrastructure—a vulnerability no financial system can afford.

The SBI report makes a straightforward case for raising the subsidy to reflect actual costs. Another option is to expand the RBI’s Payments Infrastructure Development Fund, which already supports non-urban digital infrastructure with the central bank footing the bulk of the bill. Tweaking its terms could help bridge the subsidy gap. Either way, the responsibility cannot be left to players already struggling with razor-thin margins.

UPI has become more than a domestic convenience. It has powered direct benefit transfers under Jan Dhan Yojana, served as a symbol of India’s digital soft power, and been linked with instant payment systems abroad. Countries are queuing up to replicate the model with NPCI’s help. India is now regarded as a global leader in payment systems—a reputation that brings both prestige and scrutiny.

That reputation should not rest on a fragile promise of “free” that nobody is willing to fund. If the government insists that UPI transactions remain charge-free, it must budget for it properly. If not, RBI must reopen the debate on sustainable pricing. Either way, someone has to write the cheque.

As James Hadley Chase once put it, there is always a price tag.