.png)

Deregulation: The Missing Catalyst For India's Growth

India’s economic growth hinges on reducing bureaucratic inefficiencies and fostering a more business-friendly environment. The Economic Survey 2025 underscores the need for deregulation, structural reforms, and strategic investments to sustain momentum amid global uncertainties.

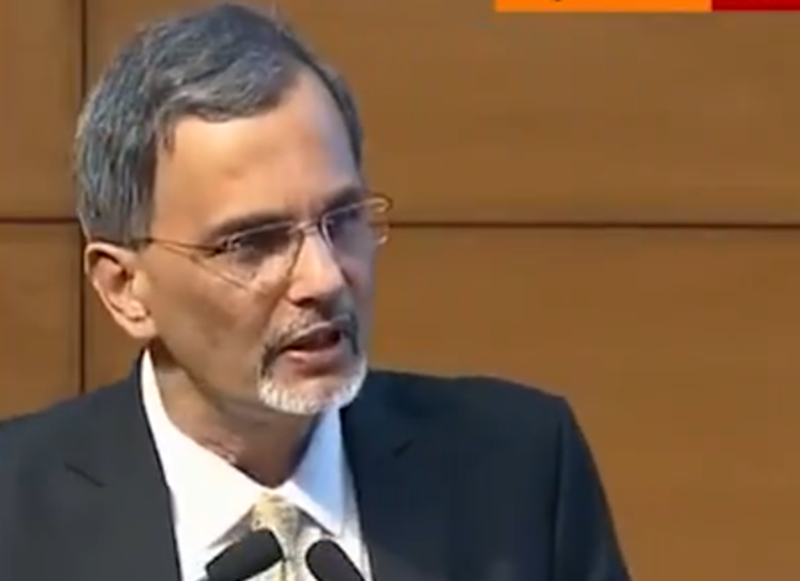

Ajay Srivastava, founder of Global Trade Research Initiative, is an ex-Indian Trade Service officer with expertise in WTO and FTA negotiations.

January 31, 2025 at 12:39 PM IST

The Economic Survey 2025 rightly highlights deregulation as a game-changer for India’s economic growth. Industrial sectors such as steel, textiles, and chemicals remain trapped in a maze of excessive regulations that stifle efficiency and competitiveness.

Take steel, for instance: despite imports accounting for just 6% of India’s consumption, cumbersome procedures continue to hinder seamless trade. The delays in issuing NOCs, the complex registration process at the SIMs portal, and the sluggish approval of foreign suppliers by BIS create a nightmarish experience for businesses. In one instance, a company was forced to pay demurrage equal to half the consignment’s value simply due to bureaucratic red tape. Such inefficiencies discourage entrepreneurship and deter investors looking for a predictable and business-friendly environment.

The government must act swiftly. India’s complex web of export and import procedures, goods and services tax compliance, quality control orders, customs notifications, and sectoral regulations must be overhauled. An independent agency should review these bottlenecks to ensure a more seamless and competitive business ecosystem. Cutting these inefficiencies alone could boost India’s gross domestic product growth by at least 2%. The Economic Survey provides the blueprint for reform—now it is up to policymakers to implement decisive action.

Economic Reality

The Economic Survey 2025 presents a nuanced picture of India’s growth story. While the economy is projected to expand by 6.4% in 2025-2026, driven by strong domestic consumption and infrastructure investment, external risks remain significant. Global trade realignments, rising geopolitical tensions, and China’s overcapacity-driven exports continue to pose challenges.

The financial sector remains a crucial pillar of India’s resilience. Credit growth expanded by 13% year on year, but the Survey warns that rising consumer credit could lead to financial instability if left unchecked. Inflation has moderated to 5.2% in December 2024, yet food price volatility remains a persistent issue, requiring urgent investment in supply chain efficiency and climate-resilient agriculture. Policymakers must also enhance food stock management and incentivise sustainable farming practices to mitigate price shocks.

India’s services sector remains the dominant growth engine, contributing over 60% to gross domestic product. Digital services, IT exports, and fintech innovations continue to propel economic activity. However, increasing global scrutiny on professional services exports poses regulatory challenges. To sustain growth in this sector, India must align its regulatory framework with evolving global trade norms while expanding skilling initiatives.

Manufacturing, on the other hand, remains underdeveloped. India accounts for just 2.8% of global manufacturing output, while China dominates at 28.8%. Regulatory inefficiencies and compliance burdens continue to limit the expansion of micro, small, and medium enterprises. Addressing these issues must be a top priority to boost industrial competitiveness and reduce dependency on imports.

Investment, Infrastructure, and Energy Security

The Survey underscores the need for higher investment levels. To maintain economic momentum, India must raise its investment rate from 31% to 35% of gross domestic product. Infrastructure investment grew 15% year on year, spurred by government-led modernisation of transport, energy, and digital networks. However, financing bottlenecks persist, making greater private sector participation crucial. Streamlining project approvals and strengthening contract enforcement will be key to attracting long-term investors.

Energy security remains another critical concern. While India has expanded its renewable energy capacity to 185 gigawatts, coal continues to play a dominant role in the energy mix. The Survey calls for a pragmatic approach—balancing emission reductions with energy security, rather than rushing into costly green transitions that could disrupt industrial output. Policymakers must focus on a phased transition while maintaining reliable power supply to sustain economic growth.

Employment Challenges

Healthcare and education remain pressing priorities. The Survey highlights a 12% year-on-year increase in health sector spending, yet rural healthcare access remains inadequate. Similarly, gaps persist in educational infrastructure, requiring stronger government intervention in skill development and vocational training. The unemployment rate has declined to 6.3% in the third quarter of 2025-2026, reflecting positive labour market trends. However, with artificial intelligence and automation set to disrupt many jobs by 2030, urgent investments in reskilling and digital literacy programmes are essential.

Economic Leadership

The Economic Survey 2025 makes a compelling case for deep structural reforms. India’s ability to navigate an increasingly fragmented global economy will depend on its commitment to deregulation, investment expansion, and climate resilience. While external headwinds persist, India must focus on strengthening its internal economic drivers—enhancing business ease, fostering industrial competitiveness, and driving innovation.

Deregulation is not just an administrative exercise—it is the key to unlocking India’s next phase of economic acceleration. Policymakers must act decisively to cut red tape, simplify compliance processes, and create a business environment that attracts both domestic and foreign investment. The blueprint for reform is clear—what remains is the political will to execute it.