.png)

RBI Anchors Inflation as Growth Levers Shift Beyond Rates

RBI has anchored long-term inflation expectations, but with growth slipping, non-rate levers now hold the key to sustaining momentum.

Shubhada Rao is the founder of QuantEco Research. Vivek Kumar and Yuvika Singhal, veteran economists, spearhead the research initiatives at the firm.

October 3, 2025 at 4:17 AM IST

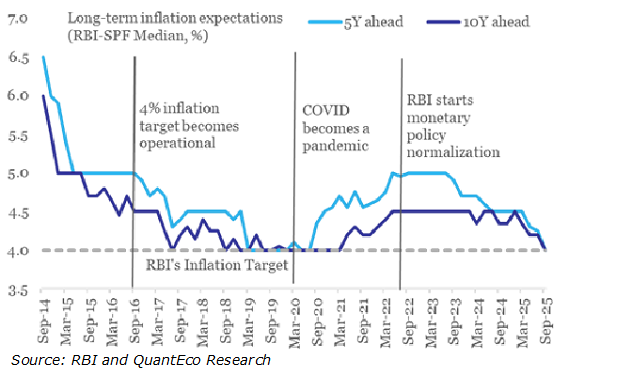

Arguably, the only metric capturing the long-term inflation expectations for the Indian economy is the Survey of Professional Forecasters that provides a ringside view of the expectations of market participants through its forward-looking surveys.

While most economic forecasts collated are of a short-to-medium term nature (1-2 years), few forecasts cover a long-term horizon - the SPF poll on CPI inflation expectations over the next 5 and 10 years is one such example.

Since market participants can be considered as a more informed cohort vis-à-vis households, whose inflation expectations are often naïve, their assessment can be viewed as a proxy for monetary policy credibility over a longer timeframe.

So, has the FIT framework served its purpose?

Long-term inflation expectations have regained their anchor

Post-COVID-related disruptions, it is noteworthy that market participants are now expecting CPI inflation to align with the 4% target over both the 5-year and the 10-year time horizon (see Chart 1).

This feat has been achieved with the post-COVID normalisation of monetary policy from the first quarter of 2022-23.

It is indeed a vote of confidence by professional forecasters as it upholds RBI’s monetary policy credibility in the current global environment, where other key central banks are still struggling to regain theirs.

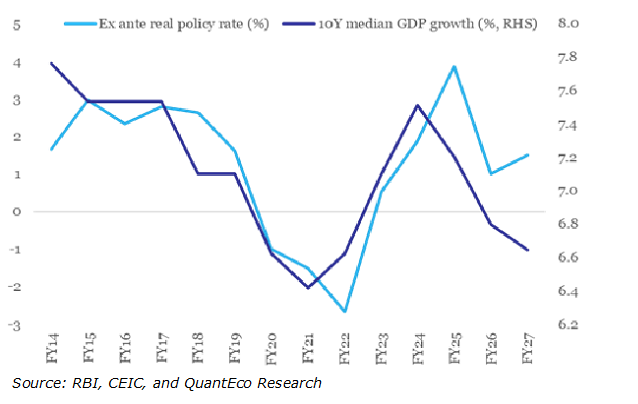

It perhaps also hints at the possibility of reaching the sweet spot where the ex ante real policy rate1 is close to its equilibrium level.

This has, however, come about with India’s trend growth2 having slipped towards the 6.5-7.0% range. Amidst a volatile and uncertain geoeconomic and geopolitical environment, the growth prospects in the near term look cloudy.

The sweeping GST reforms, while providing a buffer to growth in the near-term, are also aimed at uplifting India’s potential growth.

It is imperative that India should raise its potential growth trajectory, as has been often and amply articulated by the Monetary Policy Committee of the RBI, that while India is still one of the fastest-growing large economies in the world, the projected growth rate has been below our aspirations.

In this context, going forward, the role of policy rates as a growth enabler is increasingly shrinking with the monetary policy rate getting close to the neutral rate.

Recognising this, the RBI’s focus on accelerating non-interest rate levers to support growth is welcome.

Over the last five policy reviews, the central bank has announced an array of measures to fortify the domestic financial system, ease the flow of credit via easing of liquidity and regulatory hurdles, and create efficient and prudent risk mitigation buffers.

The October 2025 policy review doubled down on this approach.

|

RBI policy review |

Key market reform measures announced |

|

Feb-25 |

(1) Introduction of forward contracts for g-secs, (2) Expansion of retail access for secondary market transactions in g-secs. |

|

Apr-25 |

(1) Securitisation of stressed assets through market-based mechanisms, (2) Extension of co-lending to all REs and all loans, (3) Broaden the source of infrastructure financing via revised PCE guidelines |

|

Jun-25 |

100 bps cut in the CRR to be implemented in a phased manner between Sep-Nov 2025 |

|

Aug-25 |

Enable retail investors to invest in T-bills through SIPs |

|

Oct-25 |

(1) Phased implementation of ECL framework and Basel III capital adequacy norms, (2) Standardization of Credit Risk approach with lowering of risk weights for MSMEs and Residential RE, (3) Expansion of scope of capital market lending by banks for financing M&A (4) Withdrawal of the LEF framework at a banking sector level, (5) Reduction of risk weights applicable to lending by NBFCs to operational, high quality infrastructure projects, (6) Extension of time frame for repatriation from FCY accounts of Indian exporters, (7) Increasing the period for forex outlay for Merchanting Trade transactions, from 4m to 6m, (8) Promote internationalization of INR by permitting AD banks to lend in INR to non-residents from Bhutan, Nepal and Sri Lanka for cross border trade transactions, establish reference rates for currencies of India’s major trading partners to facilitate INR based transactions, and permit wider use of SRVA balances by making them eligible for investment in corporate bonds and CPs. |

The recent policy emphasis on unlocking credit by an updated rules-based system for regulation and supervision, carving out a targeted credit impulse, strengthening bank balance sheets in a calibrated fashion, and the sweeping set of measures for the development of financial markets are timely to facilitate self-reliance and enhance potential economic growth.

Focusing on the near term, the conventional monetary policy still has space to support growth, albeit by a limited degree.

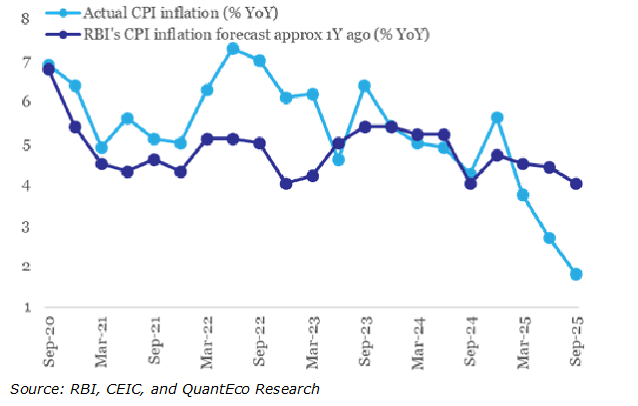

- Reasonably good marksmanship would imply that the divergence between actual inflation and that estimated a year ago is small. However, in recent quarters, the divergence has increased to its highest levels since COVID (see Chart 2). The actual inflation has turned out to be significantly lower than what was estimated by the RBI a year ago. While it is understandable that short-term volatility in food prices, which poses challenges for forecasting, has played a crucial role in the recent divergence, a rather well-behaved core inflation attests that the underlying trend remains well anchored. The extrapolation of the revamped GST structure (in terms of lower rates and process improvements) could further keep core inflation at subdued levels – as per our estimates, Core CPI inflation could potentially witness a 40 bps downside over October-March of 2025-26 and April-September of 2026-27.

- With fiscal policy maintaining discipline on both the magnitude and quality of adjustment, monetary policy could keep the ex ante real policy rate at a level not higher than 1.0% until trend growth starts showing signs of sustainable improvement. Seen from this context, one could argue for another 25-50 bps rate cut as long as the projected inflation stays close to the target (see Chart 3).

Divergence between projected inflation and actual outcome is the widest since COVID

Monetary policy has modest space for incremental easing to support growth

Overall, the RBI has done a commendable job of normalising monetary policy post the black swan shock of the pandemic. Anchoring of long-term inflation expectations is a win, though space remains for final fine-tuning.

Having said that, the geoeconomic and geopolitical game is resulting in the abandonment of old ways of doing business as new rules and partnerships are being forged. This would require non-conventional levers of policy support, a process that seems to have begun well.

Note:

- The ex ante real policy rate is defined as the nominal repo rate deflated by one year ahead CPI inflation. For the current time frame, RBI’s forecast for CPI inflation for FY26 and FY27 is considered as a proxy for future inflation. For FY28, we have assumed CPI inflation at 4.0%, in line with the signal from the latest round of the 96th round of the Survey of Professional Forecasters (Oct-25).

- This is supposed to capture potential growth, which is a derived variable based on structural models using econometric techniques. For the sake of simplicity, we have used a 10-year rolling median to construct a proxy. This is not a substitute for estimating potential growth.