.png)

US CPI Rise Overlooked as Fed Cut Bets Drive Markets; Bessent to meet Chinese Vice Premier

Here’s your quick read to start the day: a chatty, no-fuss look at overnight moves, the big story, what’s on the docket, and the tickers you need to watch.

September 12, 2025 at 1:28 AM IST

GLOBAL MOOD: Cautiously Risk-on

Investors are cautiously optimistic as US equities hit record highs, led by gains in Tesla and Micron, while inflation data and rising jobless claims keep the Federal Reserve on track for a rate cut next week. Treasury yields remain mixed, reflecting softer economic signals and demand for safer assets. Focus is also on US-China trade talks and ongoing scrutiny of TikTok and money laundering risks.

TODAY’S WATCHLIST

- India August CPI Data

- US Fed Balance Sheet

THE BIG STORY

Meanwhile, the European Central Bank kept interest rates unchanged on Thursday, maintaining a positive outlook on growth and inflation, which tempered expectations for further rate cuts. Having halved its key rate to 2% by June, the ECB emphasised that the eurozone economy remains in a “good place,” although all policy options, including additional easing, remain on the table. Recent economic data support this cautious optimism, allowing policymakers to assess the effects of US tariffs, higher German government spending, potential Fed rate cuts, and political developments in France. ECB President Christine Lagarde noted that inflation is at the target level, and the domestic economy remains solid.

Data Spotlight

Despite this inflationary pressure, first-time jobless claims climbed by 27,000 to 263,000, the highest since October 2021, highlighting a softening labour market. These mixed signals keep expectations intact for a Federal Reserve rate cut next Wednesday, with further reductions anticipated in October and December.

Takeaway: Strong US inflation in August contrasts with rising jobless claims, reinforcing bets on imminent Federal Reserve rate cuts.

WHAT HAPPENED OVERNIGHT

- US stocks hits record highs on tech gains, inflation data

- Tesla surged 6%, boosting the tech-heavy indexes.

- Strong bank stocks, including JPMorgan and Goldman Sachs, helped lift the Dow.

- Inflation and jobless data reinforced expectations of Fed rate cuts this month.

- Tesla surged 6%, boosting the tech-heavy indexes.

- US treasury yields drift amid inflation, jobless claims

- The 10-year US Treasury yield fell to five-month lows.

- Softer inflation and initial jobless claims data influenced Treasury moves.

- Long-end yields eased while short-end yields edged higher amid mixed market signals.

- The 10-year US Treasury yield fell to five-month lows.

- US dollar weakens on hopes of Fed rate cuts

- The US dollar index fell 0.28% to 97.51.

- The US dollar weakened against major currencies on Thursday amid expectations of upcoming Fed rate cuts.

- Sticky August inflation data and weaker initial jobless claims supported the view of a Fed rate cut next week.

- The US dollar index fell 0.28% to 97.51.

- Crude oil prices slide on demand concerns

- Brent crude oil fell on Thursday amid worries about weakening US demand and broad global oversupply.

- Brent crude settled down 1.7%, at $66.37 a barrel, while US WTI crude declined 2.0%, to $62.37 a barrel.

- Supply threats from the Middle East conflict and the war in Ukraine provided only limited support to prices.

- Brent crude oil fell on Thursday amid worries about weakening US demand and broad global oversupply.

Day’s Ledger

- Economic Data

- US Fed Balance Sheet

- UK Balance of Trade

- India August CPI Data

- India FX Reserves

Corporate Actions

- Adarsh Mercantile to consider fund raising

- Bohra Industries to consider fund raising

- ICICI Prudential to consider fund raising

- Star Housing to consider fund raising

Policy Events

- Russia Interest Rate Decision

Tickers to Watch

- ADANI GROUP ports to block vessels facing sanctions from the US, UK and EU

- AMBER ENTERPRISES to invest ₹2 billion in Amaravati Quantum Valley project

- BHARAT FORGE signs deal to supply 155 mm howitzer barrels to UAE-based firm

- DR. REDDY’S to acquire Janssen’s Stugeron brand for $50.5 million

- Indian court rejects ASIAN PAINTS’ petition to halt antitrust probe: report

- INFOSYS announces ₹180 billion share buyback, its largest in a decade

- JBM AUTO secures $100 million funding from IFC to deploy 1,455 e-buses

- LODHA DEVELOPERS inks ₹300 billion MoU for data centre park in Maharashtra

- RELIANCE CONSUMER to invest ₹15 billion in Nagpur food unit by 2026

- TCS launches chiplet-based services to boost semiconductor innovation

Must Read:

- Will sort out trade deal with India if it stops buying Russian oil: Lutnick

- UN Security Council will meet on Russian drone incursions, says Poland

- Adani Group ports to bar vessels facing sanctions from the US, UK, and EU

- Exporters seek loan relief, favorable rupee rate in meeting with RBI

- EU unlikely to impose 100% tariffs on India on Trump's request

- Indian banks' dividend pay-outs likely to decline 4.2% in FY26: S&P

- South Korea Warns US Immigration Raid May Hit Investment

- US Core CPI Rises as Expected, Keeping Fed on Track for Rate Cut

- NCDEX’s Equities Foray May Diversify Markets but Imperils Agri-Futures

- Urban Company Monetises India's Growing Impatience

See you tomorrow with another edition of The Morning Edge.

Have a great trading day.

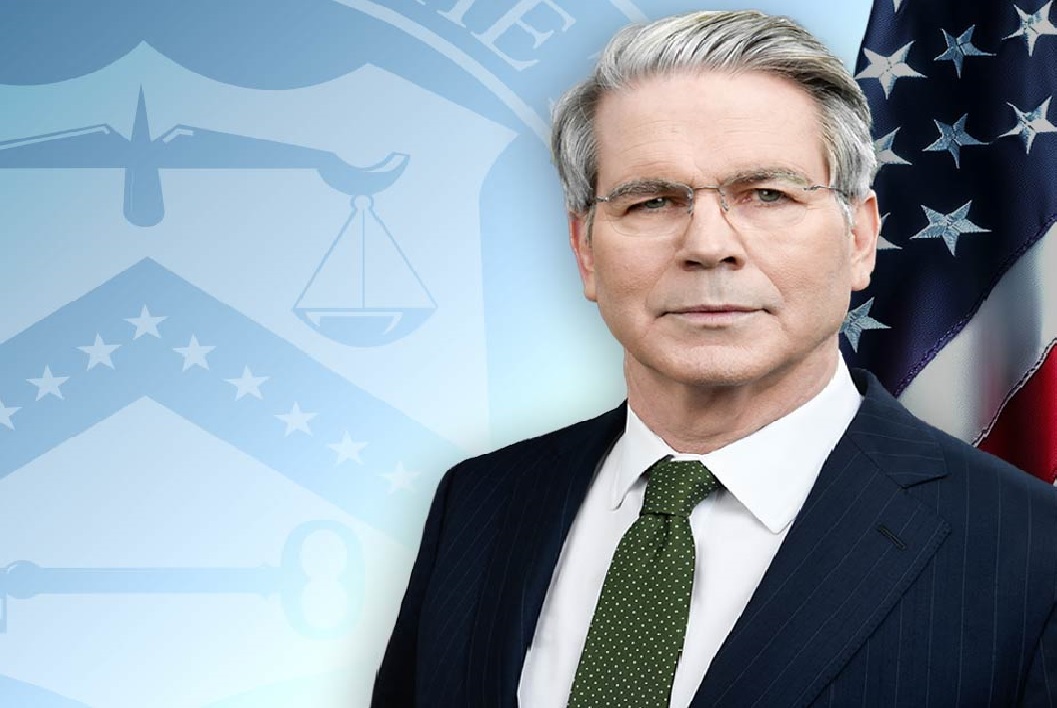

The Shifting Landscape of Global Terror

From the Mujahideen to ISIS to Hamas, terrorism feeds on grievance and survives on statecraft. The Gaza war, like Iraq in 2003, risks seeding the next cycle of global terror.

India’s model in J&K shows another way-precision operations that prioritise civilian safety. A lesson worth noting, argues Lt Gen Syed Ata Hasnain (Retd).