.png)

Trump Imposes 19% Tariff on Indonesia; EU Warns of Retaliation

A newsletter designed to prepare you for the day, offering a concise summary of overnight developments and key events ahead that could influence your workday.

July 16, 2025 at 1:22 AM IST

Global Sentiment: Risk-off

Factors: US Inflation, Trade Tension

TODAY’S WATCHLIST

- Euro May balance of trade

- US June PPI

THE BIG STORY

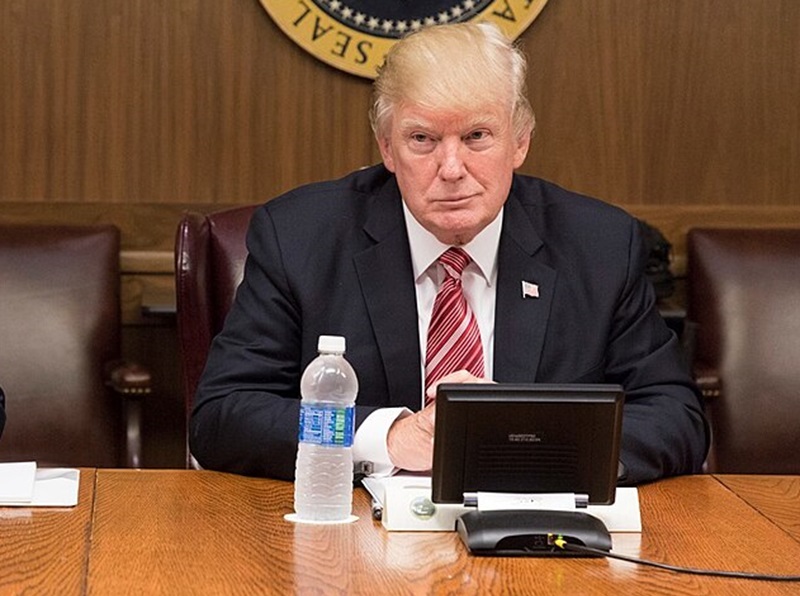

President Donald Trump on Tuesday announced a 19% tariff on goods from Indonesia as part of a new trade agreement, underscoring his push to reshape US trade terms before sweeping new tariffs take effect on August 1. The Indonesia pact, one of several modest deals struck in recent weeks, is part of Trump’s broader effort to reduce the US trade deficit and pressure countries into more favourable terms. Meanwhile, tensions with the European Union continued to escalate, with Brussels preparing retaliatory tariffs on $84.1 billion worth of US goods including aircraft, whiskey, and cars should negotiations fail. Trump is threatening to impose a 30% levy on EU imports starting next month; a move European officials say could upend trade between two of the world’s largest economies.

Against this backdrop, Boston Fed President Susan Collins said Tuesday that the US central bank remains in wait-and-see mode, as the full economic impact of the Trump administration’s tariffs continues to unfold. Speaking at a National Association for Business Economics event in Washington, Collins acknowledged that import levies will push inflation higher but suggested the damage may not be as severe as once feared. “An ‘actively patient’ approach to monetary policy remains appropriate at this time,” she said, citing still-solid consumer demand and resilient business activity. Her remarks underscore the Fed’s caution as it faces growing political pressure to cut rates while navigating rising uncertainty from trade policy.

Data

US consumer prices rose by 0.3% in June, the largest monthly increase since January, as higher costs for goods and housing signalled the early impact of tariffs on inflation. The gain, reported by the Labour Department on Tuesday, followed a 0.1% rise in May and was driven by rebounds in petrol prices, which rose 1.0%, and continued increases in food costs. Grocery prices also climbed 0.3%, with notable jumps in non-alcoholic beverages (up 1.4%) and coffee (up 2.2%), likely due to higher import duties. Rising rents also contributed to the overall uptick in the Consumer Price Index. In the 12 months through June, the CPI advanced 2.7% after rising 2.4% in May. However, weaker demand is limiting price increases in services such as airfares and accommodation, helping to keep core inflation contained.

WHAT HAPPENED OVERNIGHT

US stocks indices ended mixed on Tuesday, with the Nasdaq Composite notching another record close, driven by a sharp rally in chip stocks, while the Dow and S&P 500 slipped as inflation data and bank earnings failed to lift broader sentiment. Nvidia surged 4% after announcing plans to resume sales of its H20 AI chip to China, sparking strong gains across the semiconductor space.

US Treasury yields rose on Tuesday, reversing initial declines after stronger-than-expected inflation data cast doubt on the pace and scale of future rate cuts. The 10-year yield rose 6 basis points to 4.487%, a peak since June 11, while the 30-year yield surpassed 5% for the first time since late May. The two-year yield, which closely tracks expectations for Federal Reserve policy, jumped 5.6 basis points to 3.955%.

The US dollar climbed on Tuesday, hitting a 15-week high against the Japanese yen after consumer prices rose by the most in five months, prompting markets to scale back expectations for rate cuts this year. The dollar strengthened 0.78% to 148.85 yen, as the hotter-than-expected inflation print reinforced the view that the Fed is likely to remain on hold for now. broader dollar index rose 0.52% to 98.63, while the euro slid 0.52% to $1.1602 and sterling weakened 0.34% to $1.3379.

Brent crude oil prices edged lower on Tuesday, with traders shrugging off concerns of immediate supply disruption following President Trump’s 50-day ultimatum for Russia to end the war in Ukraine or face sanctions. The measured timeline appeared to ease near-term geopolitical risk, prompting a modest pullback in crude. US West Texas Intermediate settled down 0.69% at $66.52 a barrel, while Brent crude slipped 0.72% to close at $68.71.

Day’s Ledger

Economic Data

- Euro May balance of trade

- US API Crude Oil Stock Change

- US June PPI

- UK June Inflation Rate

Corporate Actions

- Apr-Jun earnings: Angel One, Axtel Industries, DB Corp, Heubach Colorants, ITC Hotels, JTL Industries, Kabra Extrusion, L&T Technology, LE Travenues, Lotus Chocolate, Onward Technologies, Oriental Hotels, Reliance Industrial, Switching Technologies, Tanfac Industries, Tech Mahindra, Tree House, Twin Roses, Varun Mercantile.

- Bluegod Entertainment to consider stock split

- Ishan Dyes to consider fund raising

- Reliance Infrastructure to consider fund raising

- Reliance Power to consider fund raising

- SBI to consider fund raising

- Tirupati Tyres to consider fundraising

- Trishakti Industries to consider fund raising

Policy Events

- Fed Collins Speech

- Fed Logan Speech

- Fed Barr Speech

- Fed Hammack Speech

Tickers

- AXIS BANK gets Crisil ‘AAA’ rating with stable outlook for proposed ₹80-bln infra bonds; existing Tier-II and infra bonds worth over ₹412 bln reaffirmed.

- AUROBINDO PHARMA and CIPLA receive sublicences to manufacture long-acting HIV drug Cabotegravir LA under expanded global licensing pact with ViiV and MPP.

- BANK OF MAHARASHTRA eyes 17% credit growth in FY26; to add 321 branches in 18 months, June quarter net profit jumps 23% YoY to ₹15.93 bln.

- BRIGADE ENTERPRISES expands BuzzWorks brand in Hyderabad with 50,000 sq ft centre at Mindspace; adds 1,000 flexible workspaces.

- DIXON TECHNOLOGIES to form JV with China’s Chongqing Yuhai for precision components; also to acquire 51% in Q Tech India for camera, fingerprint modules.

- HCL TECHNOLOGIES June quarter profit down 10% YoY to ₹38.43 billion; revenue up 8% to ₹303.49 billion; announces ₹12 interim dividend; maintains FY26 guidance.

- HDFC LIFE June quarter profit rises 14.4% YoY to ₹5.46 bln on strong AUM and premium growth; VNB improves to ₹8.1 bln with 25.1% margin.

- HIMADRI SPECIALITY June quarter net profit rises 48% YoY to ₹1.82 bln despite 6.8% drop in revenue; other income doubles; tax and finance costs increase.

- ICICI LOMBARD June quarter profit jumps 29% YoY to ₹7.47 bln on lower underwriting losses; premium growth muted due to regulatory changes; solvency ratio at 2.70x.

- KOTAK MAHINDRA BANK Chief Credit Officer Phani Shankar resigns, effective Jul. 22; bank puts interim credit structure in place.

- LEMON TREE HOTELS opens 64-room hotel in Erode, Tamil Nadu, taking total portfolio to over 220 properties; sixth operational hotel in state.

- RAILTEL secures ₹2.64 bln order from East Central Railway to deploy Kavach train collision avoidance system across 607 route km.

- RAIL VIKAS NIGAM wins ₹4.47 bln Delhi Metro contract for viaduct and station construction under Phase IV; 36-month timeline set.

- SUN PHARMA settles Leqselvi litigation with Incyte; signs licensing deal for deuruxolitinib use in alopecia areata and other non-oncology uses.

- TATA CONSULTANCY SERVICES partners MIT Sloan for multi-sector AI research series; aims to decode human-AI collaboration in enterprise transformation.

- TATA TECHNOLOGIES June quarter profit drops 9.7% QoQ to ₹1.70 bln; revenue slips 3.1% to ₹12.44 bln; EBITDA margin narrows to 16.1%.

- YES BANK to review fundraising and June quarter results on Saturday; earlier approved ₹160 bln fundraise in June; aims to strengthen capital base.

- ZYDUS LIFESCIENCES gets USFDA approval to launch generic Celecoxib capsules in US; annual market size pegged at $122.6 mln.

MUST READ

- RBI may cut rates further if inflation falls or growth slows: Governor Malhotra

- UK aviation regulator backs Boeing, says no safety concerns found

- Youth unemployment rises to 15.3% in June, labour participation dips

- Tesla Model Y launches at ₹60L in India: Here's how much it costs worldwide

- HCLTech sees rating downgrade post Q1 results, guidance disappointment

- RBI Governor hints at allowing foreign banks to own 26% in Indian lenders

- Economy to grow at 6.5% in FY26 despite global tensions, trade uncertainties

- ‘Great deal’: Donald Trump hints at trade agreement with Indonesia

- US core CPI rises less than expected again despite tariff impact

- Fed Chair contender is now in favor of cutting rates, just as Trump wants

- China’s GDP beat masks fragile demand, sparking outlook concerns