.png)

The Morning Edge: Top Trump Aides Set for High-Stakes Trade Talks with China in London

A newsletter designed to prepare you for the day, offering a concise summary of overnight developments and key events ahead that could influence your workday.

June 9, 2025 at 1:25 AM IST

QUICK SNAPSHOT

Global Sentiment: Risk-on

Factors: US Employment Data, Trade Talks

TODAY’S WATCHLIST

- China May trade data

- Japan GDP data

THE BIG STORY

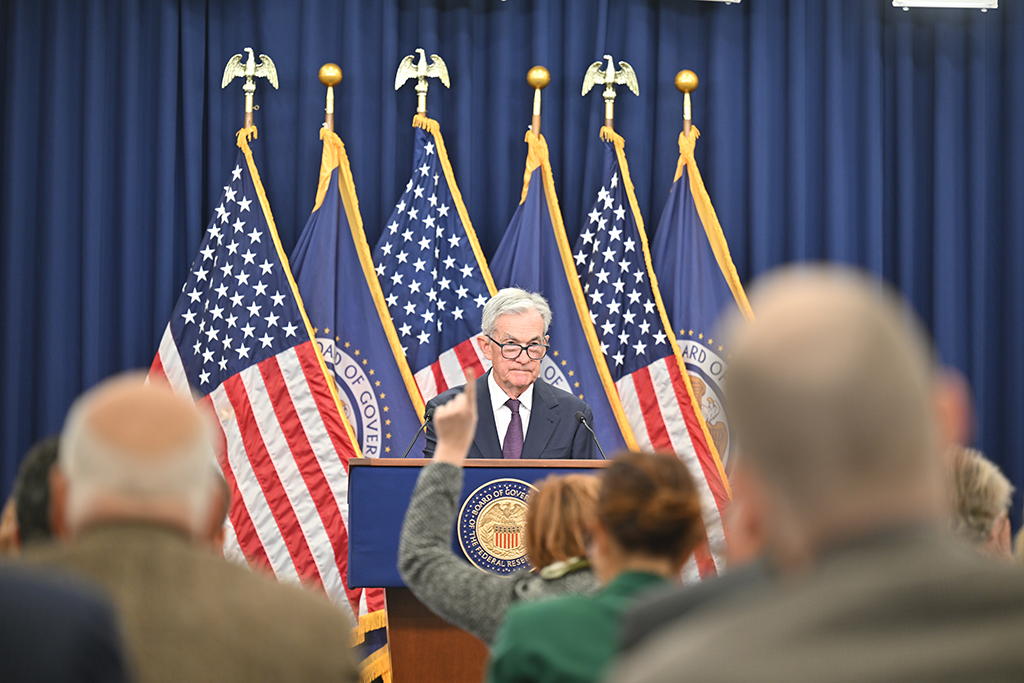

As trade tensions simmer between Washington and Beijing, three of President Donald Trump’s top economic advisors are heading to London for a pivotal round of negotiations aimed at cooling the conflict. Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and Trade Representative Jamieson Greer will meet with Chinese Vice Premier He Lifeng in what marks the first session of a newly revived US-China economic consultation mechanism.

The talks follow a rare direct call between Trump and Chinese President Xi Jinping last week, during which the two leaders touched on trade and the escalating standoff over critical minerals. While few details have been disclosed, Trump expressed optimism on Truth Social, predicting the London meeting “should go very well.” With global markets watching closely, the outcome could prove decisive in shaping the next chapter of the fragile US-China trade relationship.

DATA

US job growth slowed in May as uncertainty over the Trump administration's import tariffs weighed on hiring decisions, though solid wage gains may keep the broader economic expansion intact. The Labor Department's report on Friday highlighted weakening labour market momentum, with downward revisions shaving 95,000 jobs off the March and April totals. Non-farm payrolls rose by 139,000 last month following a downwardly revised gain of 147,000 in April.

The unemployment rate remained unchanged at 4.2% for the third straight month, largely due to 625,000 people exiting the labour force, a sign of declining confidence in job prospects. Consumer surveys have echoed this unease, with growing concerns about the ability to find new employment if laid off. Still, wage growth offered a silver lining, potentially giving the Federal Reserve more leeway to delay interest rate cuts.

WHAT HAPPENED OVERNIGHT

US stocks closed higher on Friday after a stronger-than-expected jobs report eased concerns over the economic outlook, while Tesla rebounded from the prior session’s steep losses. The S&P 500 ended above the 6,000 marks for the first time since February 21, driven by strength in technology shares. Investor sentiment was further lifted by news that three US cabinet officials are set to meet with Chinese representatives in London on June 9 to discuss a potential trade deal. Tesla shares rose 3.8% after Thursday’s 15% drop amid President Donald Trump's public feud with Elon Musk. Other tech heavyweights also gained, with Amazon up 2.7% and Alphabet rising 3.25%. Wells Fargo added 1.9% after S&P Global raised its outlook on the bank to "positive" from "stable," following the recent removal of a $1.95 trillion asset cap.

US Treasury yields climbed on Friday after the latest jobs report pointed to a cooling but still resilient labour market, prompting investors to reassess the outlook for interest rate cuts. The yield on the 10-year Treasury note rose nearly 7 basis points to 4.45%, as the data reinforced the Federal Reserve’s cautious stance on holding rates steady. Following the report, market expectations for a rate cut in September were dialled back, with the probability slipping to around 75% down from full pricing earlier in the week.

The US dollar rose against major currencies on Friday after a stronger-than-expected May jobs report suggested the Federal Reserve may delay interest rate cuts. The dollar climbed 0.95% to 144.87 against the Japanese yen and gained 0.26% to 0.822 versus the Swiss franc, extending its lead over both traditional safe-haven currencies. The greenback posted second consecutive weekly gain against the yen and franc. The euro slipped 0.43% to $1.1395 following the data.

Brent crude oil prices climbed more than $1 a barrel on Friday, marking their first weekly gain in three weeks. The rally was driven by a better-than-expected US jobs report and the resumption of trade negotiations between the US and China, renewing hopes for economic growth in the world's two largest oil consumers. Brent crude futures settled at $66.47 a barrel, rising $1.13 or 1.73%, while US West Texas Intermediate crude closed at $64.58, up $1.21 or 1.91%.

Day’s Ledger

Economic Data:

- Japan March quarter GDP data

- Japan April current account data

- China May CPI data

- China May trade data

Corporate Actions:

- Simbhaoli Sugars board to consider Jan-Mar earnings

Policy Events

- ECB's Elderson speaks

TICKERS

- AFCONS INFRASTRUCTURE secured a contract from RELIANCE INDUSTRIES for Vinyl Project works in Dahej. Contract value is approximately ₹7 billion, with actual payment based on work completed.

- ASIAN PAINTS faces a CCI complaint from Birla Opus Paints, alleging dominance abuse. Dealers were allegedly warned against doing business with GRASIM INDUSTRIES.

- BHARAT ELECTRONICS signed an MoU with TATA ELECTRONICS to jointly develop semiconductors and defence-grade electronics, aiding India’s self-reliance in chip design, OSAT and fabrication.

- GHV INFRA PROJECTS received a ₹5.46 billion road strengthening order in Mumbai from GHV (INDIA). The domestic project will be completed within 24 months.

- HCL and RITES partnered to bid for mineral blocks and develop mining infrastructure, supporting India’s mineral self-reliance goals.

- JK CEMENT acquired a 60% stake in Saifco Cements for ₹1.50 billion. Saifco is now a subsidiary.

- KEC INTERNATIONAL won orders worth ₹22.11 billion across T&D, oil & gas pipelines, and cables. Year-to-date intake now exceeds ₹42 billion, up 40% YoY.

- LARSEN & TOUBRO became the first Indian firm to issue ₹5 billion in ESG bonds under SEBI’s new sustainability-linked framework.

- MAHINDRA & MAHINDRA reported May sales at 80,458 units, up 17% YoY. Production rose 28% to 89,626 units, while exports declined 27% to 2,671 units.

- MARUTI SUZUKI expanded solar capacity by 30MWp via two projects. Total solar capacity rose to 79MWp, with a target of 319MWp and ₹9.25 billion investment by FY31.

- PRESTIGE ESTATES will launch 25 residential projects in FY26 with an estimated revenue potential of over ₹421.2 billion from 44.80 million sq ft area.

- RAILTEL received an LoI from Maharashtra’s Motor Vehicles Department to implement ITMS at blackspots. Estimated project value is ₹2.74 billion, with execution due by 2036.

- RITES and HINDUSTAN COPPER signed an MoU to build a resilient mineral value chain, with RITES offering logistics and consultancy for mining and transport infrastructure.

- UPL will benefit as its associate Serra Bonita plans to sell all assets for $125 million. UPL owns a 33% stake and will receive a share of the proceeds.

MUST READ

- Lilavati Trust alleges fraud against HDFC Bank CEO, bank calls it ‘malicious’

- US trade team said to extend India stay as talks gather momentum

- India will protect farmers' interest in US trade talks: Shivraj Singh Chouhan

- US-China trade talks in London to tackle fresh disputes, tariff truce

- Trump says Musk relationship over, warns of 'serious consequences' if he funds Democrats

- India Inc's dividend payout rises 11% to record ₹5 trillion in FY25

- Revised CPI series may track more markets, ecom data in major cities

- India’s rare earths push can’t afford a delay now

- Singapore casts tax shadow on India bets, shuns shell companies

- BYD Unleashes an EV Industry Reckoning That Alarms Beijing