.png)

The Morning Edge: Rate Cuts in Europe Reflect Dimming Inflation Outlook, Global Uncertainty

A newsletter designed to prepare you for the day, offering a concise summary of overnight developments and key events ahead that could influence your workday.

June 20, 2025 at 1:33 AM IST

QUICK SNAPSHOT

Global Sentiment: Risk-off

Factors: Israel-Iran conflict

TODAY’S WATCHLIST

- RBI MPC Meeting Minutes

- PBoC Loan Prime Rate decision

THE BIG STORY

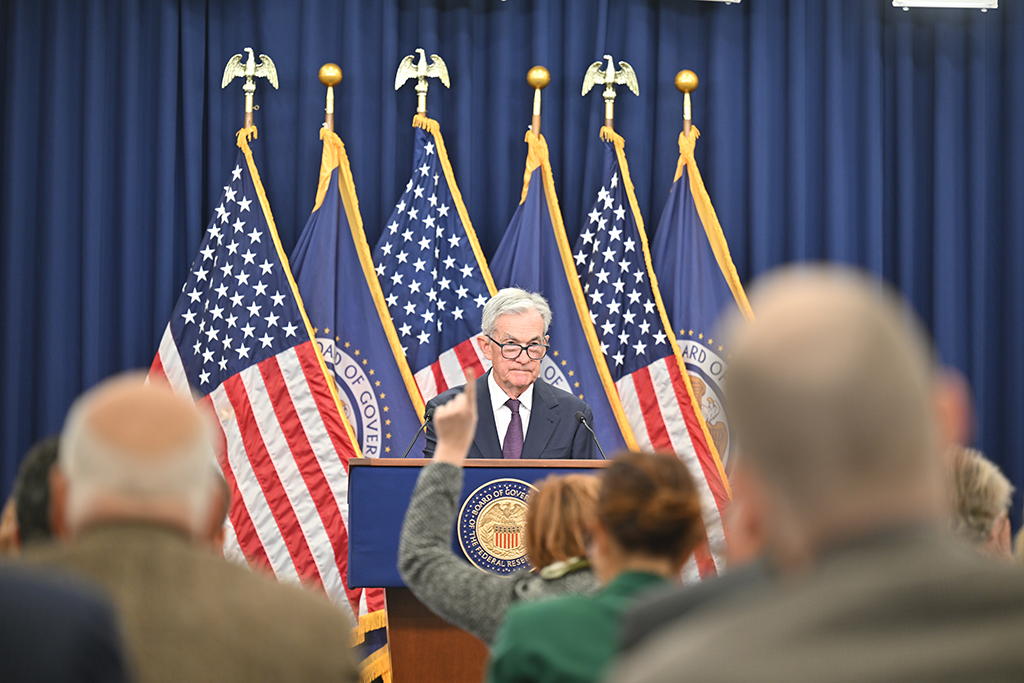

A sharp policy divergence emerged across the Atlantic on Thursday as central banks in Switzerland, Norway, and Sweden cut interest rates in response to a softer inflation outlook, while the Federal Reserve stood pat on Wednesday, warning of "meaningful" price pressures ahead. The Bank of England also kept rates unchanged but signalled a gradual downward path, acknowledging growing global uncertainty and trade-related risks—moves that collectively underscored Europe’s shift toward easing.

By contrast, the US Federal Reserve's decision on Wednesday to hold rates steady, paired with only a cautious projection of two cuts later this year, drew sharp criticism from President Donald Trump. Fed Chair Jerome Powell cited Trump’s own aggressive trade tariffs as a driver of upcoming inflation and signalled that any easing would depend heavily on how those inflation risks evolve. Market strategists believe the Fed might be underestimating underlying economic weaknesses, especially in the labour market, which existed before the tariff shock. This raises doubts about whether the US can afford to fall behind its more dovish European counterparts.

DATA

Japan’s core consumer inflation accelerated to 3.7% year-on-year in May, the fastest pace since January 2023, fuelled by stubborn food price pressures. The figure, which exceeded expectations of 3.6% and followed a 3.5% rise in April, adds to the Bank of Japan’s policy dilemma as it weighs interest rate hikes against a fragile domestic economy and external threats from rising US tariffs. The inflation trend highlights persistent cost pressures despite weak demand, raising concerns about the sustainability of Japan’s post-pandemic recovery.

Meanwhile, British consumer confidence improved to its highest level of 2025 in June, with sentiment about the economy strengthening, according to a GfK survey released on Friday. The index rose to -18 from -20 in May, defying expectations for an unchanged reading. However, the upbeat mood remains fragile as geopolitical risks loom—particularly the possibility of surging energy costs due to the ongoing conflict in the Middle East. These pressures could reverse gains in household optimism in the months ahead.

WHAT HAPPENED OVERNIGHT

US stocks and Treasury markets were closed on Thursday for Juneteenth public holiday.

The US dollar inched up on Thursday as escalating tensions in the West Asia supported demand for safe-haven assets. The dollar index held steady at 98.9, on track for a 0.8% weekly gain—its best performance since late February. Against the yen, the dollar rose 0.2% to 145.56, while the euro slipped 0.1% to $1.1473. A flurry of rate decisions across Europe underscored the challenges central banks face in navigating inflation, trade frictions, and geopolitical volatility. The dollar's resilience reflects renewed investor appetite for stability amid rising global uncertainty.

Brent crude oil prices rallied on Thursday, with Brent crude settling up 2.8% at $78.85 per barrel its highest close since January 22 amid intensifying military exchanges between Israel and Iran. West Texas Intermediate crude rose 2.7% to $77.20, as traders weighed the risk of broader regional disruption and the possibility of US involvement. Geopolitical tensions have kept energy markets volatile, even as thin trading volumes due to the US federal holiday added to price swings

Day’s Ledger

Economic Data:

- Japan May National CPI data

- UK May Core Retail Sales data

- German May PPI data

- US Philadelphia Fed June Manufacturing Index

- US Baker Hughes Oil Rig Count

Corporate Actions

- Jan-Mar earnings: Droneacharya Aerial, Panyam Cements

- Bandaram Pharma to consider share issue

- Focus Lighting to consider bonus share issue

- Manba Finance to consider NCDs issue

- Panth Infinity to consider fund raising

- Ugro Capital to consider fund raising

Policy Events

- RBI MPC Meeting Minutes

- PBoC Loan Prime Rate decision

- BoJ Monetary Policy Meeting Minutes

- ECB Economic Bulletin

TICKERS

- Biocon raises ₹45 billion via QIP at ₹330 per share, closing issue at 3% discount to floor price. Allots 136.36 million shares.

- Brigade Enterprises informed that BuzzWorks leases 24,000 sq. ft to Infor in Hyderabad’s HITEC City. Plans to reach 1 million sq. ft by FY26-end.

- Crisil completes ₹332.5 million minority stake buy in Online PSB Loans. Firm provides AI-driven MSME and retail loan platforms.

- Diageo India t buy remaining 70% in NAO Spirits, valuing it at ₹1.30 billion. To invest ₹200 million more for working capital.

- Lemon Tree Hotels signs pact for 60-room resort in Madhya Pradesh. To be operated by Carnation Hotels with full amenities.

- LTIMindtree launches Blue Verse unit to accelerate AI adoption. Offers 300+ industry-specific solutions and contact centre-as-a-service.

- Mastek unveils Adopt.AI suite to push enterprise AI. Targets adoption across technology, data and business workflows.

- Natco Pharma gets 7 US FDA observations for Kothur unit. Says it will address all points within deadline.

- Samvardhana Motherson to buy remaining 25% in two Turkish JVs for €3.23 million. Firms will become wholly-owned arms.

- Samvardhana Motherson to form EV parts JV with Korea’s Egtronics; to hold 51%. Also invests ₹141.3 million in solar power firm.

MUST READ

- TCS says co not under probe in M&S breach; Chandra skips AGM for first time

- India's largest port builder to raise ₹300 billion for Vadhvan project

- Indian IPO market heads for busiest week with $1.7 billion in deals

- Trump calls Jerome Powell 'real dummy', 'worst' as Fed holds rates steady

- RBI relief for project finance, only 1% provision in construction phase

- SEBI allows IAs, RAs to use MFs, overnight funds to meet deposit norms

- Bank of England holds interest rates amid inflation and global risks

- IMF Chief says now is great time to boost global role of Euro

- Windfall levy accounted for one third of BP’s 2024 UK tax bill

- Israel hits nuclear sites, Iran strikes hospital as war escalates

- Oil, war and tariffs tear up markets' central bank roadmap

- Global IPO activity slumps in 2025 as tariffs, volatility weigh