.png)

Dev Chandrasekhar advises corporates on big picture narratives relating to strategy, markets, and policy.

Sunil is an entrepreneur. He also advises businesses on supply chains, sales, and partnerships for growth

August 26, 2025 at 2:29 PM IST

India's securities market regulator believes extending the tenure of option contracts can curb excessive speculation. On Thursday, SEBI Chairman Tuhin Kanta Pandey said the regulator is exploring ways to increase the maturity of equity derivatives contracts. But sophisticated traders rarely comply just because regulators tell them to. Reduced leverage and long-term contracts will push activity toward other alternatives such as cryptocurrencies, gold, forex or overseas stock markets, where rapid-fire trading opportunities remain intact.

The scale of India’s derivatives market is staggering. In the second quarter of 2024, the country’s two main exchanges handled more than 36.8 billion equity index options, accounting for more than two-thirds of all futures and options traded globally. India built the world's largest derivatives ecosystem, with daily turnover of $3 trillion, only to systematically dismantle it through regulatory action.

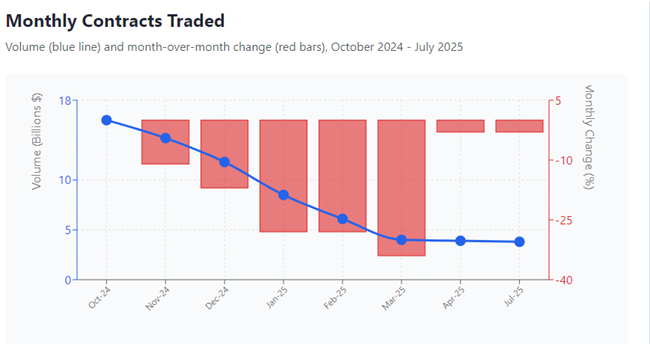

The crackdowns have already triggered massive outflows. Volumes plummeted 76%, from 16 billion contracts in October 2024 to 3.8 billion in July 2025. Far from successful policy implementation, this represents capital flight to more accommodating venues.

Alternative Markets

Cryptocurrency markets present the most compelling alternative. Platforms such as Delta Exchange offer Bitcoin and Ethereum derivatives settled in rupees, while Binance allows trading in more than 400 cryptocurrencies through UPI transfers. International exchanges like BitMEX and Deribit offer leverage up to 100 times with round-the-clock trading. A retail trader might find perpetual swaps with such leverage irresistible.

Forex markets offer even greater scale. Although direct forex platforms face FEMA restrictions, international brokers such as IG and FOREX.com offer CFD trading services to Indian residents. With a $7.5 trillion daily turnover, the global forex market dwarfs India's derivatives activity, offering weekly expiries and leverage up to 30 times.

Gold derivatives complete the triangle. Around 90% of global gold trading occurs on London's OTC Market, New York's COMEX, and the Shanghai Gold Exchange. International brokers offer gold CFDs and futures with leverage up to 20 times, often without tenure restrictions.

Opening accounts typically requires basic KYC and margin deposits, with many platforms supporting rupee transactions. Unlike Indian exchanges, most offshore platforms don't deduct tax at source.

| Platform Examples | Leverage | Expiry choices | |

| Crypto | Delta Exchange, Binance, BitMEX | Up to 100x | Perpetual, weekly |

| Forex | IG, FOREX.com, Interactive Brokers | Up to 30x | Weekly, monthly |

| Gold | COMEX, London OTC, CFD brokers | Up to 20x | Weekly, monthly |

SEBI’s Paradoxes

SEBI's stated goal is to protect retail investors, 91% of whom posted net trading losses totalling ₹1 trillion in 2024-25. Extending tenure won't change behavioural patterns. Instead, it pushes them toward less regulated markets with higher leverage and fewer safeguards.

The contradiction becomes starker when considering SEBI's broader ambitions. The regulator expects India's investor base to triple to 400 million by 2030. Yet the same retail expansion could be undermined by restrictions. Weekly options derive their appeal from time decay and volatility, precisely what extended tenures eliminate.

Market structure usually trumps regulatory intent. Capital flows to wherever it faces fewer restrictions. SEBI's proposed tenure extension may reduce domestic speculation, but only by exporting it offshore.

Rather than watching this exodus accelerate, SEBI should enhance surveillance capabilities, improve investor education, and address structural liquidity imbalances. The regulator's good intentions risk handing India's derivatives trade to less scrupulous jurisdictions. It’s a victory for neither market integrity nor investor protection.