.png)

India’S E-Rupi: The Digital Currency Experiment That Needs A Bigger Push

India’s e-Rupi has significant potential but faces slow adoption due to low awareness, infrastructure gaps, and policy challenges. To scale up, policymakers must enhance digital literacy, connectivity, and trust. If successful, e-Rupi could revolutionize direct benefit transfers and strengthen India’s digital finance ecosystem.

Arti Singh covers fintech and finance, shaping impactful stories at Mint, ET Prime, and The Morning Context. She now runs The Head and Tale.

January 31, 2025 at 11:38 AM IST

India has long been a trailblazer in digital financial innovation, revolutionising payments through its Unified Payments Interface. But when it comes to rolling out digital currencies, progress has been more measured. While the Reserve Bank of India experiments with a central bank digital currency, a parallel initiative—the government’s e-Rupi—offers a glimpse into how direct benefit transfers could be reimagined in an increasingly digital economy.

Can e-Rupi scale up to become a game-changer in welfare distribution, or will it remain a footnote in India’s digital finance evolution?

Globally, digital currencies are seen as a means to streamline transactions, enhance transparency, and foster financial inclusion. But in India, where government welfare schemes support millions of people, the stakes are even higher. A more efficient system could plug leakages, ensure timely fund disbursal, and eliminate middlemen.

The numbers are staggering. India transferred ₹2.23 trillion ($27 billion) across 1,206 welfare schemes so far in 2024-25 through direct benefit transfers. The transaction volume exceeded 1.8 billion, underscoring the scale of the challenge.

While direct benefit transfers have improved efficiency, they remain vulnerable to identity mismatches, delays, and fund misappropriation. A digital currency integrated with Aadhaar or Jan Dhan accounts could reduce these inefficiencies by enabling real-time, purpose-specific transfers.

Enter e-Rupi, launched in 2021 as a digital voucher distributed via SMS or QR codes.

Unlike direct cash transfers, where funds can be repurposed, e-Rupi ensures that subsidies—for healthcare, education, or fertilisers—are used only for their intended purpose. It is, in essence, a more controlled and accountable version of direct benefit transfers.

Big Potential

On paper, e-Rupi is tailor-made for India. It does not require a bank account, making it accessible to 120 million unbanked citizens. Its targeted allocation prevents diversion of welfare funds, and its reliance on India’s well-established digital payments infrastructure should make adoption seamless.

But uptake has been sluggish. Only 3 million e-Rupi vouchers were issued between January and December 2024—a drop in the ocean compared to direct benefit transfers. While the total value of these vouchers remains undisclosed, the modest numbers highlight a gap between intent and execution.

Several challenges hinder adoption. Awareness remains low, particularly in rural areas where beneficiaries are unfamiliar with digital tools. Intermediaries resist the transition, fearing displacement. And despite India's fintech prowess, patchy mobile connectivity in rural regions restricts digital access.

India is not alone in its digital currency ambitions. China has already begun paying some state employees in digital yuan, though most recipients immediately convert it to cash.

This underscores two crucial takeaways: infrastructure is everything, and trust is non-negotiable.

While India’s Unified Payments Interface success is enviable, digital literacy remains a weak link. Additionally, concerns over privacy and state surveillance could discourage widespread adoption unless regulators provide transparent safeguards.

For e-Rupi to scale up, policymakers must address key barriers:

Digital infrastructure: Over 500 million Indians still lack internet access, mostly in rural areas. A digital currency cannot succeed without a stronger connectivity backbone.

Digital literacy: Many potential beneficiaries struggle with basic digital tools. Large-scale grassroots education campaigns, led by NGOs and local bodies, are essential.

Cybersecurity risks: Expanding digital ecosystems heighten fraud risks. A robust security framework is critical.

Policy coordination: Direct benefit transfers via digital currency require seamless coordination across the Reserve Bank of India, government departments, and technology providers. Fragmented implementation will limit impact.

Road Ahead

Despite its slow start, e-Rupi is a step in the right direction. To scale effectively, the government must pilot targeted expansions in high-impact sectors, such as healthcare and education, while simultaneously bolstering digital infrastructure in rural areas.

Ultimately, e-Rupi may be a small piece in India’s digital finance puzzle, but its success—or failure—will shape the country’s readiness for a full-fledged digital currency. If policymakers resolve existing bottlenecks, e-Rupi could not only perfect direct benefit transfers but also establish India as a leader in the global digital currency revolution, just as it did with the Unified Payments Interface.

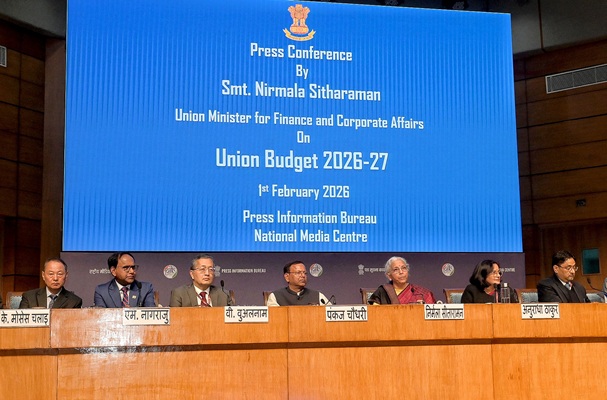

The opportunity is there for the seizing. Will the Budget mandate some spends via e-Rupi?