.png)

India’s Corporate Debt Dilemma: Short-Term Safety Over Long-Term Growth

The rise in short-term commercial paper issuances versus declining issuance of BBB-rated bonds signals lender caution. Despite RBI rate cuts, financing cost for India’s largest pool of commercial borrowers remains high, threatening economic growth and job creation.

Dev Chandrasekhar advises corporates on big picture narratives relating to strategy, markets, and policy.

February 12, 2025 at 5:04 AM IST

India’s bond market is flashing warning signs. While the Reserve Bank of India cut the repo rate by 25 bps to 6.25% on February 7, optimism for cheaper corporate credit remains misplaced. Risk-averse investors are fleeing long-term bonds for short-term commercial papers, leaving BBB-rated borrowers — the backbone of India’s job-creating mid-and-small enterprises sector — stranded in a liquidity drought.

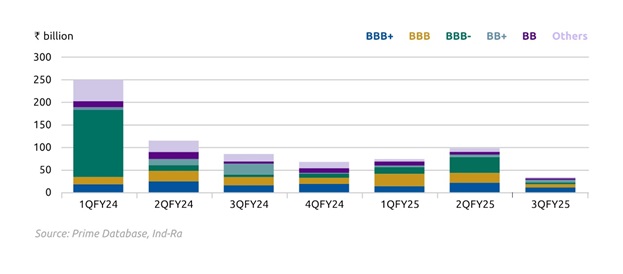

Data from India Rating and Research reveals a troubling divergence: issuances of BBB-rated bonds, the lowest rung of investment-grade debt, have plummeted, while CPs from the same entities remain robust. This flight to short-term instruments reflects growing caution about corporate India’s medium-term health. Investors, wary of deterioriating asset quality in retail subprime portfolios and economic headwinds, are prioritising liquidity over yield. The result is a dysfunctional credit market where even modest rate cuts fail to trickle down to high-risk borrowers.

BBB Debt Matters

BBB-rated companies occupy a shaky middle ground: solvent enough to avoid junk status, yet too fragile to inspire confidence in turbulent times. Their bonds, traditionally a staple for pension funds and insurers, offer marginally higher yields than government securities but demand constant reassessment of risk. When these borrowers retreat from the bond market, it signals a broader credit crunch.

This dynamic sets off an adverse chain reaction. Reduced bond demand forces issuers to offer higher yields, which means the company has to pay more in interest to borrow the same amount, increasing its cost of financing. This stifles investment in expansion or innovation, hurting India’s already-slowing GDP growth. It creates a vicious cycle since squeezed cash flows weaken credit profiles further, deterring lenders.

False Comfort

CPs, with maturities under a year, offer temporary respite. For companies, they bridge immediate liquidity gaps; for investors, they minimise exposure to long-term uncertainties. However, this preference for short-term debt carries hidden costs. Rolling over CPs every 90-180 days locks borrowers into volatile interest cycles, leaving them vulnerable to future rate hikes or market freezes. For India’s subprime MSMEs — already grappling with delayed payments and thin margins — this compounds financial risks.

Subprime borrowers — lacking collateral or credit history — rarely benefit from macro-level adjustments. The RBI’s rate cut, though welcome, highlights the limits of monetary policy in addressing structural credit gaps. Instead, targetted interventions may prove more effective. Given the challenges in transmitting lower repo rates to high-risk borrowers, several steps might be required:

Targeted liquidity support: Expand credit guarantee schemes to underwrite BBB bond issuances, reducing lender risk. The Centre and the regulator must accelerate efforts to deepen and broaden the corporate bond market, including measures to improve liquidity and transparency. Additionally, promoting the development and use of credit default swaps and other risk mitigation instruments could help manage credit risk.

Bond market reforms: Incentives for investors to engage in longer-term lending, potentially through tax benefits or regulatory adjustments, could also be considered. Establishing a task force to closely monitor bond market trends and recommend timely interventions when necessary could help sustain stability.

Finally, ensuring better coordination between monetary and fiscal policy could create a more conducive environment for long-term credit growth.

Domino Effect

Equity investors, too, should heed the bond market’s distress signals. History shows that prolonged credit squeezes precede earnings downgrades and valuation corrections. They stifle corporate investment in productive assets, leading to slower growth rates, potentially impacting job creation. As companies tighten their belts, the ripple effects can touch various sectors from manufacturing to services, ultimately affecting consumer confidence and spending.

Investors often view the bond market as a barometer of economic health. A slowdown in bond activity can lead to increased volatility in equity markets amid concerns about economic stability. This interconnectedness underscores the importance of monitoring bond market trends, as they can signal broader economic shifts.

India’s debt market conundrum brings to light a harsh truth: until regulators address the structural aversion to risk—through guarantees, market incentives, or calibrated reforms—the RBI’s rate cuts would only offer marginal relief. For MSMEs, the lifeline of India’s economy employing over 241 million, bridging the confidence gap is imperative.