.png)

Babuji K is a career central banker with 35 years at RBI in exchange rate management, reserve operations, supervision, and training.

June 2, 2025 at 9:43 AM IST

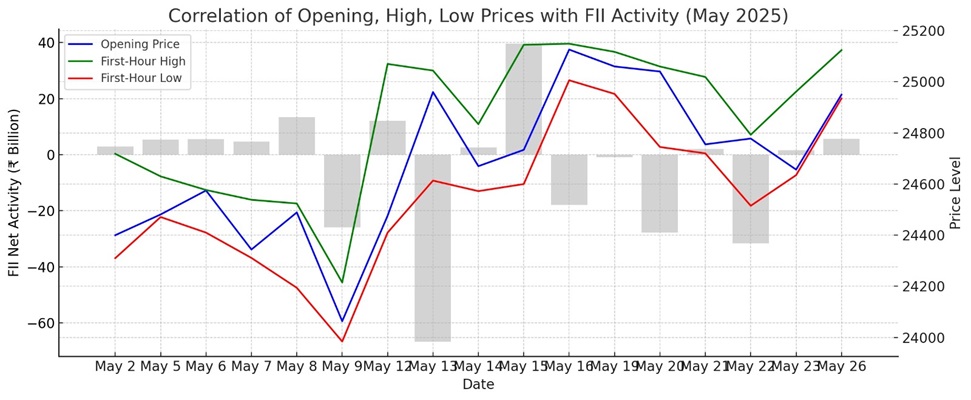

Foreign institutional investors returned to Indian equity derivatives in May with renewed intent. After a subdued presence through late 2024 and early 2025, FIIs re-engaged with Nifty futures in both scale and sequence. A closer reading of the data from May 1-25 suggests that early trades — particularly in the first hour of the session — may carry more signal than is typically acknowledged.

This observation, while limited in duration, aligns with long-established institutional behaviour. Large global investors, including central banks, sovereign funds, and long-only portfolios, often front-load orders to minimise market impact and exploit cleaner liquidity early in the day. In India’s case, where Nifty futures are highly liquid and tightly linked to spot moves, this approach becomes more visible on the tape.

Across several sessions in May, early price movements in Nifty futures appeared to mirror the directional stance of FIIs.

May Trend

While not every session fit this pattern precisely, the directional alignment was frequent enough to be noted. Days such as May 6 and May 16, where FII buying was not accompanied by price gains, may reflect prior positioning, saturation, or the influence of offsetting domestic flows. Volatility on May 13 illustrates that early price action is still subject to broader intraday dynamics.

What emerges is not a claim of causality, but a behavioural cue. Institutions tend to act early when they are confident in their positioning. When these moves are consistent and visible, they may offer useful information about the day’s prevailing bias — at least from the vantage point of large, directional capital.

This pattern may be of interest not just to market participants, but to policymakers and supervisors observing how flows behave in real time. Understanding when institutions choose to express market views — not just what they trade or in what quantity — is becoming more relevant as liquidity fragments across venues and products. Timing, particularly in the early part of the session, may now be a component of signalling worth closer scrutiny.

India’s futures market structure lends itself well to such analysis. With high turnover, tight spreads, and co-movement with cash markets, the Nifty futures contract is a natural barometer for early institutional intent. While this note draws only from a short sample, it flags a potentially useful input for surveillance frameworks, reserve managers, and others who track market pulse beyond headline flows.

Understanding not just what institutions are trading, but when and how they act, is increasingly important in modern markets. In futures, where large players execute with precision, the timing of trades can often reveal more about intent than size alone.

This note does not assert a definitive correlation. It offers a preliminary observation — that the first hour of trade, often dismissed as noise, may in fact be among the most revealing periods of the day.