.png)

Krishnadevan is Editorial Director at BasisPoint Insight. He has worked in the equity markets, and been a journalist at ET, AFX News, Reuters TV and Cogencis.

March 23, 2025 at 2:49 AM IST

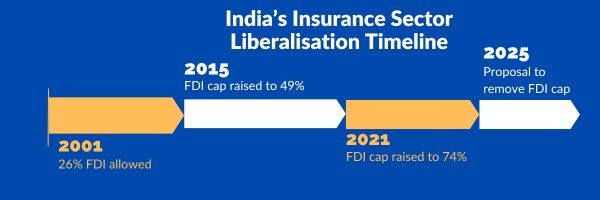

The government’s proposal to allow 100% foreign direct investment in insurance appears bold at first glance, but the fine print will decide whether the reform genuinely liberalises the sector or only shifts control while preserving older constraints in new forms.

The key concern among insurers is the ambiguity surrounding capital deployment. The condition that all premium collections must be invested in India raises red flags. Policyholder funds are already restricted, but it remains unclear whether the same restrictions will now apply to shareholder capital. This uncertainty may cause hesitation among global insurers who otherwise see India as a growth market.

Regulatory precedent has shown that headline liberalisation often comes with caveats. When the FDI cap was raised to 74% in 2021, new conditions were introduced, including mandatory profit retention under certain solvency situations. These conditions, aimed at safeguarding financial stability, also diluted investor confidence. A similar outcome could unfold unless the current amendments remove ambiguities and create a truly level playing field.

Full foreign ownership could upend the current market structure. Foreign partners in existing joint ventures may now seek to buy out Indian promoters entirely. That would accelerate ownership consolidation and reduce the role of Indian promoters in the long run. If composite licences and lower capital requirements are also introduced, the industry could see structural shifts favouring larger, more diversified players.

Smaller insurers and state-owned firms are worried. Without protective regulation, these entities may find it hard to compete with well-capitalised global firms that bring scale and technical know-how. This could lead to a widening gap in sectoral capabilities unless supported by targeted regulation or public investment.

The Insurance Regulatory and Development Authority of India has already been moving to harmonise rules for GIFT City. If the new FDI norms apply differently to entities there, it could raise fresh concerns over regulatory arbitrage.

Beyond ownership, the bigger issue is relevance. India’s insurance offerings have failed to keep pace with evolving risks—cyber threats, climate events, and intangible assets remain underinsured. Foreign insurers with full ownership and control may be better placed to address these gaps with global product innovations and operating models.

That said, deeper reforms are still needed to fix legacy challenges. Distribution inefficiencies, poor renewal systems, and low financial literacy keep insurance penetration low. Higher FDI won’t resolve these unless accompanied by parallel efforts to improve consumer protection and product relevance.

Resistance from employee unions and agents shows this reform will face political and social friction. Many stakeholders fear that foreign dominance could mean job losses and reduced local control. The final legislation will need to balance openness with safeguards to avoid backlash.

For now, the reform signals intent. Its success will depend not on the headline number, but on whether the operational rules enable real capital, innovation, and competition to flow in. In insurance, as always, the devil is in the details.