.png)

Bessent Flags Room for Aggressive Fed Cuts Amid Soft US Data

Here’s your quick read to start the day: a chatty, no-fuss look at overnight moves, the big story, what’s on the docket, and the tickers you need to watch.

August 14, 2025 at 1:48 AM IST

GLOBAL MOOD: Risk-On

Drivers: Fed rate cut hopes, Geopolitical Tensions

Markets remain risk-on as the moderate inflation print and slowing job growth bolster expectations of a Federal Reserve rate cut, supporting equities and reducing Treasury yields.

TODAY’S WATCHLIST

- China July Industrial Production

- US Initial Jobless Claims

- US July PPI

- Earnings: Ashok Leyland, Indian Oil Corporation, Vodafone Idea

THE BIG STORY

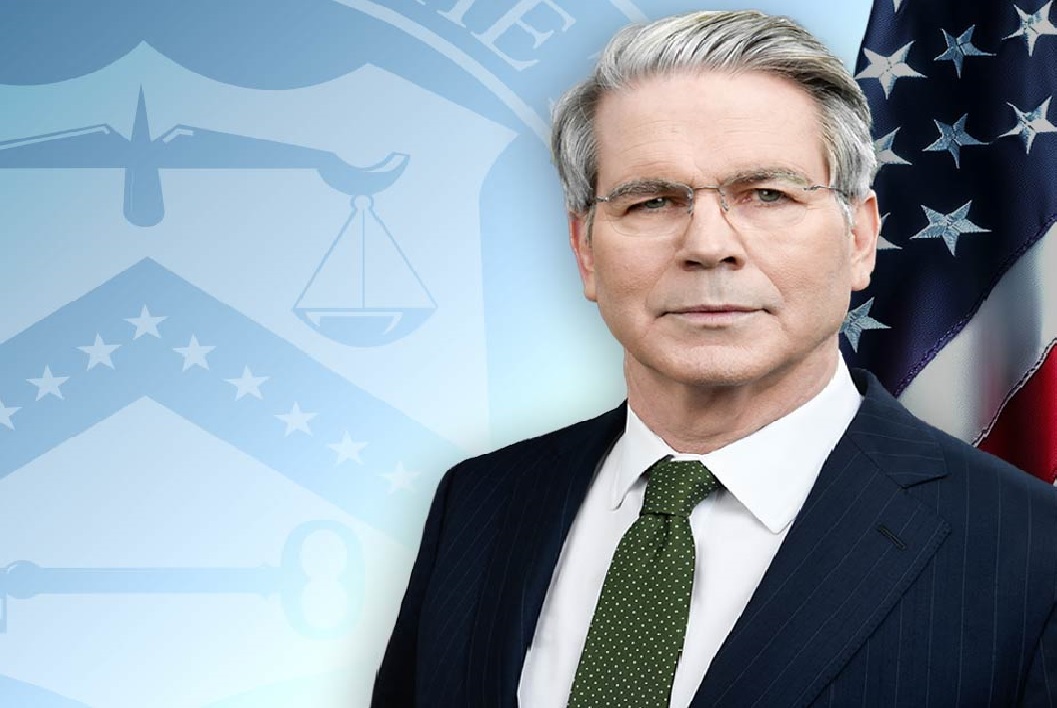

The probability of a Federal Reserve rate cut in September is now viewed as nearly certain after US inflation rose moderately in July and Treasury Secretary Scott Bessent highlighted weak job growth in May, June, and July. Bessent suggested an aggressive half-point cut is possible, noting that had employment data been this soft earlier, rate reductions could have occurred in June and July. He added that rates remain “too constrictive” and should likely be 150–175 basis points lower.

Meanwhile, Goldman Sachs projected three 25-basis-point Fed cuts this year and two more in 2026, bringing the terminal rate to 3–3.25% from the current 4.25–4.50% range. Tuesday’s data showed consumer prices rose 0.2% in July after a 0.3% gain in June, aligning with expectations and supporting the case for easing.

Data Spotlight

The UK Residential Market Survey from RICS showed a notable slowdown in July 2025, with the house price balance falling to -13%, down from -7% in the previous two months and marking the weakest reading in a year. The decline also missed expectations for a modest improvement to -5%. Despite the overall weakness, prices continued to rise in Northern Ireland and Scotland, while respondents in the Northwest of England reported gains.

In the US, crude oil inventories rose by 3.037 million barrels in the week ended August 8, 2025, contrary to expectations of a 0.8-million-barrel decline, according to the EIA Petroleum Status Report. Stocks at the Cushing, Oklahoma delivery hub increased by 45 thousand barrels. Among refined fuels, gasoline inventories dropped by 0.792 million barrels, while distillate fuel stocks rose by 0.714 million barrels.

Takeaway: The UK housing market shows continued cooling, signaling potential regional pressure on prices, while US crude builds suggest easing supply concerns despite seasonal demand fluctuations.

WHAT HAPPENED OVERNIGHT

- US stocks rise amid hope of Fed rate cuts

- S&P 500 and Nasdaq hit record closing highs in hopes of an approaching Fed easing cycle.

- Tech-heavy “Magnificent Seven” stocks saw mixed performance.

- Apple surged 1.6% on news of plans to expand into AI-powered robots, home security, and smart displays.

- US Treasury yield pulls back as Fed rate-cut bets resurface

- The yield on the 10-year US Treasury note fell, ending a six-session streak of rises.

- Market focus shifted to expectations of lower interest rates by the Federal Reserve.

- Around two-thirds of the market is pricing in up to three rate cuts by year-end.

- US dollar weakens as rate-cut bets gain momentum

- US dollar weighed down by expectations of a Federal Reserve rate cut.

- The dollar index fell 0.2% to 97.856, its lowest since July 28.

- Crude oil prices slide to two-month low amid supply concerns

- Brent crude prices fell to over two-month lows on bearish supply guidance from the US and EIA.

- Investors monitored geopolitical tensions, including Trump’s warning to Putin over peace in Ukraine

Day’s Ledger

Economic Data:

- China July Industrial Production

- Euro June Industrial Production

- India July Passenger Vehicles Sales

- US Initial Jobless Claims

- US July PPI

- US Fed Balance Sheet

Corporate Actions:

- Earnings: Ashok Leyland, AstraZeneca Pharma, Glenmark Pharma, Hindustan Copper, Indian Oil Corporation, Patanjali Foods, and Vodafone Idea

- Sayaji Industries to consider bonus share

- Vipul Ltd to consider fund raising

Policy Events:

- Fed Barkin Speech

Tickers to Watch

- Aditya Birla Fashion reports ₹2.12 billion loss in Apr-Jun vs ₹1.61 billion loss last year

- Brigade Enterprises reports PAT ₹1.50 billion vs ₹837.2 mln last year

- BPCL PAT ₹61.24 billion vs ₹30.15 billion last year

- Engineers India Q1 profit ₹700.8 mln vs ₹547.8 mln last year

- IRCTC to close JV with Cox & Kings after 13 years of inactivity

- L&T arm, Japan’s ITOCHU sign green ammonia project pact in Gujarat

- Muthoot Finance profit ₹20.46 billion vs ₹10.79 billion last year

- Nuvama Wealth profit ₹2.21 billion vs ₹465.4 mln last year

- Pfizer profit ₹1.92 billion vs ₹1.51 billion last year

- RVNL bags ₹900 mln project from Southern Railway

- United Spirits profit ₹2.58 billion vs ₹2.99 billion last year

- US FDA gives no observations to Zydus Life Ahmedabad unit

- Wipro, Google Cloud deliver 200 AI agents across industries

Must Read:

-

ICICI Bank revises minimum account balance to ₹15,000 from ₹50,000 after outcry

-

Banks to clear cheques within hours from October 4, says RBI

-

Trump aims for Ukraine ceasefire at Alaska summit with Putin, says Macron

-

SBI to raise ₹150 billion via Tier II bonds to replace maturing debt

-

Jio BlackRock debut powers record July inflows in mutual fund NFOs

-

IBBI proposes cap on assignments for insolvency professionals to curb delays

-

China to continue anti-dumping tariff on Indian fibre optic products

-

US national debt reaches record $37 trillion

See you tomorrow with another edition of The Morning Edge.

Have a great trading day.

Can Tata Motors Pull Off Another JLR with Iveco?

In 2008, Tata Motors turned a $2.3 billion JLR gamble into a global success story. Now, it’s making a bet on Iveco, aiming to double CV revenues and expand across Europe & Latin America.

Dev Chandrasekhar’s writes the €3.8 billion debt-financed acquisition requires flawless execution simultaneously across multiple regulatory jurisdictions, technology platforms, and competitive battlegrounds.