.png)

February 17, 2025 at 1:20 AM IST

Prime Minister Narendra Modi’s recent summit with former US President Donald Trump reinforced efforts to expand bilateral trade to $500 billion. However, a full-fledged India-US Free Trade Agreement remains unlikely. Washington prefers sector-specific tariff deals over broad reductions and is reluctant to ease visa norms, limiting India’s gains in services. Many trade issues are already covered under the Indo-Pacific Economic Framework, which India is a member of. Despite their trade deal, President Trump’s past tariffs on Mexico and Canada highlight his scepticism toward comprehensive agreements. Instead of pushing for an overarching deal, India could focus on sectoral partnerships in technology, defence, energy, space, and supply chains. A key opportunity lies in joint solar manufacturing, which could reduce reliance on China. Meanwhile, President Trump's claims that India enjoys a $100 billion trade surplus with the US are overstated. The actual figure for 2024 is $41 billion, with total trade at $170 billion. As India and the US navigate these complexities, targeted economic cooperation may yield faster gains than a sweeping trade pact. In the near term, both sides should be expected to deepen engagements in strategic sectors while balancing domestic political concerns. So, some calm can be expected.

Weekend

Data

US retail sales tumbled 0.9% in January, the sharpest decline since March 2023, missing expectations of a 0.1% dip and signalling that inflationary pressures and tariff uncertainty may be dampening consumer spending. The data, coupled with a downwardly revised 0.5% rebound in December.

Federal Reserve data showed factory output slipped 0.1% in January, missing estimates for a modest gain, as a sharp drop in motor vehicle production weighed on the manufacturing sector. The weak industrial performance highlights persistent challenges in manufacturing and reinforces fears of slowing economic momentum.

Markets

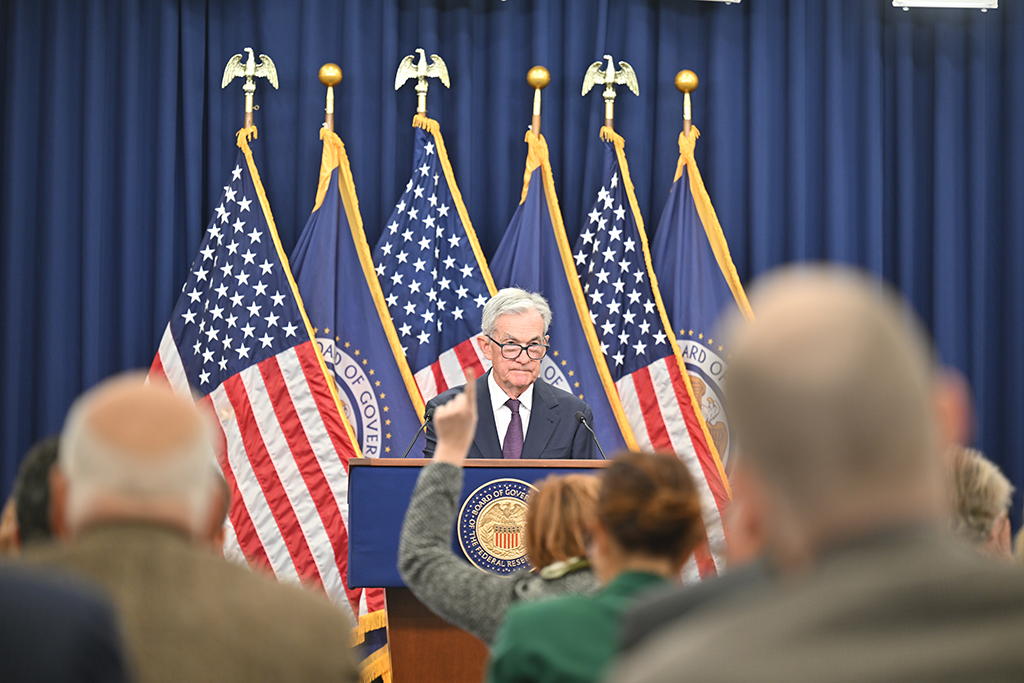

The US stocks closed mixed on Friday, with tech giants Nvidia and Apple climbing 2.6% and 1.3%, respectively, while Microsoft and Amazon fell 0.5% and 0.7%. The market reaction came a day after President Trump unveiled reciprocal tariff plans but delayed implementation, easing some trade-related concerns. Airbnb surged 14% after reporting stronger-than-expected quarterly revenue, while DaVita tumbled 11% as the dialysis firm projected annual profit below estimates, compounded by Warren Buffett’s Berkshire Hathaway trimming its stake in the company. The mixed session reflected investor caution amid lingering trade uncertainties and corporate earnings surprises, with markets continuing to weigh the broader economic outlook and Federal Reserve policy expectations.

The US Treasury yields edged lower on Friday as softer-than-expected retail sales data and the latest tariff developments fuelled speculation that the Federal Reserve may find room to accelerate rate cuts. In response, the yield on the benchmark 10-year Treasury note slipped 4.7 basis points to 4.478%, though it remained on track for a weekly gain after declining in the previous two weeks. Despite the dip, broader market sentiment suggests investors remain cautious, balancing Fed rate-cut expectations against ongoing inflation concerns and geopolitical uncertainties.

The US dollar reported a weekly loss against the euro on Friday, as a delay in implementing US trade tariffs eased concerns about their potential economic impact. At the same time, optimism over a possible peace deal between Russia and Ukraine bolstered the single currency. The dollar index, which tracks the greenback against a basket of major currencies, fell 0.3% to 106.77, hitting a nine-week low of 106.56 earlier in the session.

Crude oil prices reversed course to end lower on Friday, as optimism over a potential Russia-Ukraine peace deal was offset by uncertainty stemming from a delay in the US reciprocal tariffs. US crude settled 0.77% lower at 70.74 a barrel, while Brent crude dipped 0.3770.74 a barrel. The mixed signals from geopolitical developments and trade policy left markets grappling with conflicting pressures on global energy demand and supply dynamics.

Day’s Ledger

Economy

- Japan GDP data for December quarter

- Japan industrial production data for December

- Eurozone trade balance data for December

- India trade balance for January

Companies

- ABB India to announce December quarter earnings and dividend

- Sampann Utpadan India to consider fund raising plans

- SBI Cards and Payment Services to consider dividend

Policy

- Finance Minister Nirmla Sitharaman and all secretaries in finance ministry and the Chief Economic Advisor to address media in Mumbai.

- Germany Deutsche Bundesbank President Nagel Speaks

- US FOMC Member Harker Speaks

- US FOMC Member Bowman Speaks

Tickers

- ADITYA BIRLA FASHION reported a net loss of ₹513 million in December

quarter. - ALEMBIC PHARMACEUTICALS has received an Establishment Inspection Report with a classification of Voluntary Action Indicated from the US FDA for its solid oral formulation facility at Jarod.

- AUROBINDO PHARMA to begin European supplies from China facility in April

- BHEL secured an order worth ₹67 billion from Singareni Collieries Company to establish an 800 MW thermal power unit in Telangana.

- DISH TV INDIA reported a net loss of ₹465 million in October-December as the company's revenue from operations fell 21% on year to ₹3.73 billion.

- GLENMARK PHARMA reported a net profit ₹3.48 billion in October-December versus a net loss of 3.51 billion rupees.

- MAHINDRA LIFESPACE DEVELOPERS plans to raise up to ₹15 billion through issue of shares to eligible shareholders for reducing its debt as well as funding further growth.

- NARAYANA HRUDAYALAYA’s net profit for quarter ended December rose mere 2.6% on-year to ₹1.93 billion.

- RAIL VIKAS NIGAM reported 13.1% on year decline in consolidated net profit to ₹3.11 billion in December quarter.

- SAMVARDHANA MOTHERSON’s net profit for December quarter jumped 62% year-on-year to ₹8.79 billion driven by steady revenue growth and improved operational efficiency.

- SHRIRAM FINANCE - The Reserve Bank of India has imposed a monetary penalty of ₹580,000 on the company for non-compliance with certain provisions related to KYC norms.

- UTKARSH SMALL FINANCE BANK reported a net loss of ₹1.68 billion for the quarter ended December 31.

Must Read

- DeepSeek AI Drives $1.3 Trillion Rally in Chinese Stocks

- DOGE Cancels $21 Million Funding for 'Voter Turnout in India'

- First 'Made-in-India' Chip to Launch by October: Vaishnaw

- FPIs Withdraw ₹212.7 billion from Equities in February

- India, US to Deepen Space Cooperation with New Agreements

- Indian companies cautious amid Trump's threat of reciprocal tariffs

- Russia's Advance in Ukraine Is Slowing: Analysis

- Stampede at New Delhi Railway Station: Death Toll Rises to 18

- US Heavy Bombs Arrive in Israel After Trump Reverses Biden Pause

- US to Deport 119 More Indians Amid Immigration Crackdown

- Delhi's Air Quality Deteriorates to 'Poor' Category

Daily Mantra

Each morning is a fresh start—a chance to move forward with quiet confidence. Progress isn’t always loud; sometimes, it’s in the small steps, the steady efforts, the quiet resilience. Trust your journey, stay open to possibilities, and let today be about momentum, not perfection. You’re already on your way.